| SHIPPING RATES & BUNKERS ( 9:20 am ET ) | |||

| DIRTY TANKER (KT - $/day) | VOYAGE | SPOT TCE EARNINGS | 2018 AVG. RATE |

| VLCC, 270 | AG-FE | 14,200 | 9,800 |

| Suezmax, 130 | WAF-UKC | 3,700 | 5,100 |

| Aframax, 70 | CAR-USG | 500 | 5,600 |

| Panamax, 50 | CAR-USG | 8,300 | 6,500 |

| CLEAN TANKER (KT - $/day) | VOYAGE | SPOT TCE EARNINGS | 2018 AVG. RATE |

| MR, 37 | UKC-USAC | 5,000 | 6,800 |

| MR, 38 | USG-UKC | (1,800) | 800 |

| TIME CHARTER (KDWT) | 1YR ECO RATE ($/day) | NEWBUILD PRICE ($M ) | SECONDHAND 5YR PRICE ($M) |

| VLCC , 200+ | 26,000 | 90.0 | 61.0 |

| Suezmax, 130-200 | 19,000 | 60.0 | 42.0 |

| Aframax, 80-130 | 16,000 | 48.0 | 30.0 |

| LR2, 80-130 | 16,000 | 50.0 | 31.0 |

| LR1, 60-80 | 13,750 | 43.0 | 26.0 |

| MR, 42-60 | 13,750 | 35.5 | 25.5 |

| Handymax. 30-42 | 12,500 | 33.0 | 23.0 |

| US FLAG (KT - $/day) | VOYAGE | WEEKLY SPOT RATE | 2018 AVG. RATE |

| Handy, 38 | USG-USAC | 58,070 | 62,643 |

| LNG ($/day) | WEEKLY SPOT RATE | CURRENT MONTH RATE | 2018 AVG. RATE |

| 160M3 Tri-fuel diesel electric (West) | 74,000 | 74,000 | 66,688 |

| 138-150M3 Steam turbine (West) | 56,000 | 56,000 | 46,406 |

| 160M3 Tri-fuel diesel electric (East) | 63,000 | 63,000 | 55,719 |

| 138-150M3 Steam turbine (East) | 44,000 | 44,000 | 36,813 |

| LPG (KT) | LAST POSTED SPOT RATE ($/mt) | SPOT TCE RATE ($/day) | 1yr TIME CHARTER RATE ($/day) |

| VLGC, 44 (AG-Japan) | 40.14 | 20,559 | 17,270 |

| BUNKERS ($/mt) | IFO 380 | MDO | |

| US Gulf | 409.5 | 677.0 | |

| Rotterdam | 413.0 | 622.0 | |

| Singapore | 454.5 | 655.5 | |

ENERGY NEWS

Cheniere's bid to feed first gas to Texas LNG plant approved.

The US energy regulator has approved Cheniere Energy's request to feed the first gas into its new LNG facility in Corpus Christi, signaling the beginning of a commissioning phase for the export terminal. The FERC approval means the company will be able to produce the first commissioning cargo by 4Q 2018, if not earlier. Train 1 at the Corpus Christi facility will become the first LNG export terminal in Texas, and the third functioning one in the US. Cheniere's Sabine Pass terminal, with four trains, is the largest LNG facility in the US with a 18 mmta capacity. Over a dozen trains are slated to become operational next year on the US East Coast, adding 36 mmta to global LNG supply compared to the 290 mmta traded in 2017.

AP Moller-Maersk to spin off oil drilling rig arm.

The Danish firm attempted to sell Maersk Drilling but received disappointing bids, causing it to star the spin-off that should generate proceeds of about $1.2B next year. Maersk decided to break the conglomerate in 2016 and focus on global trade, concentrating on its shipping, port terminals and logistics business. Since then, however, oil prices have recovered while container shipping has entered a difficult period partly due higher fuel costs. The firm has secured debt financing of $1.5B for its drilling unit and aims to spin it off to existing shareholders in 2019 when it becomes a separate listed company in Copenhagen.

FT Aug 17, 2018

Japan's Mitsubishi Corp to acquire 25% stake in Bangladesh LNG terminal.

The remaining 75% of the Summit LNG terminal will remain with Summit Corp. Summit LNG's plans for the project call for a FSRU to be installed off the coast of Moheshkali, where it will receive and regasify LNG procured by Petrobangla, the national oil and gas company. Construction works have commenced, with commercial operation expected to start in Mar. 2019. The planned import volumes are about 3.5 mmta. Mitsubishi is reportedly investing about $20M-$25M for the 25% equity. The Japanese giant also announced plans to help develop an offshore receiving site in the South Asian country.

EU approves Danish renewable energy plans.

EU state aid regulators approved three Danish renewable energy plans, worth a total of €144M, as part of the country's goal of loosening its dependence on fossil fuels by 2050. The three projects are aimed toward supporting electricity production from wind and solar this year and next. One is a €112M plan that includes onshore and offshore wind turbines and solar installations. Another, worth €27M, is for onshore wind test and demonstration projects. The third €5M project is a transitional measure for onshore wind.

| COMMODITIES, (9:20 am ET ) | ||||

| CRUDE | SOURCE | UNIT | LAST PRICE | Δ PRIOR DAY CLOSE |

| Brent | ICE | $/bbl | 72.40 | +0.97 |

| WTI | NYMEX | $/bbl | 66.20 | +0.74 |

| Dubai (Spot) | Bloomberg | $/bbl | 70.08 | +0.97 |

| PRODUCTS | SOURCE | UNIT | LAST PRICE | Δ PRIOR DAY CLOSE |

| RBOB Gasoline | NYMEX | ₵/gal | 200.71 | +1.97 |

| Heating Oil | NYMEX | ₵/gal | 212.18 | +2.54 |

| NATURAL GAS | SOURCE | UNIT | LAST PRICE | Δ PRIOR DAY CLOSE |

| US Henry Hub | NYMEX | $/MMBtu | 2.94 | +0.03 |

| UK National Balancing Point | ICE | $/MMBtu | 8.13 | +0.16 |

| NATURAL GAS LIQUIDS | SOURCE | LAST PRICE (₵/gal) | LAST PRICE ($/mt) | Δ PRIOR DAY CLOSE(₵/gal) |

| US Mont Belvieu Propane (Spot) | Bloomberg | 94.25 | 491.30 | +1.00 |

| PRICE SPREADS ($/bbl) | SOURCE | LAST PRICE | Δ PRIOR DAY CLOSE | |

| Brent 3-2-1 Crack | ICE | 10.74 | -0.03 | |

MARKETS

| MARKETS, ( 9:20 am ET ) | ||||

| EQUITIES | REGION/COUNTRY | LAST VALUE | Δ PRIOR DAY CLOSE | |

| S&P 500 | United States | 2,840.69 | +22.32 | |

| FTSE 100 | United Kingdom | 7,524.83 | -31.55 | |

| DAX | Germany | 12,151.39 | -85.78 | |

| Nikkei | Japan | 22,270.38 | +78.34 | |

| SH Composite | China | 2,668.97 | -36.23 | |

| CURRENCIES | REGION/COUNTRY | LAST VALUE | Δ PRIOR DAY CLOSE | |

| £/$ | United Kingdom | 1.27 | +0.00 | |

| €/$ | European Union | 1.14 | +0.00 | |

| $/JPY ¥ | Japan | 110.40 | -0.49 | |

| $/CNY ¥ | China | 6.88 | -0.01 | |

MARKET ANALYSIS

- Asphalt: Rockies regional retail prices firmed in a number of areas last week, with wholesale ranges up too.

- LNG: As winter approaches, with Far East gas prices expected to rise and a high number of vessels deliver onto their forward multi-month charters, charterers with spot shipping opportunities should expect to see much stronger commercial terms going forward.

- LPG: A number more spot AG cargoes were offered into the market last week as Chinese buyers looked to secure more AG-origin material in the face of heavy tariffs being imposed on US cargoes.

- Oil prices on track for weekly fall on concerns over trade tensions.

AUG. POSTED / SPOT PRICES ($/mt)

| AUG. POSTED / SPOT PRICES ($/mt) | Propane | Butane |

| Saudi Aramco | 580.00 | 595.00 |

| Sonatrach | 555.00 | 570.00 |

| OPIS North Sea | 552.00 | 533.00 |

| Spot AG | 567.50 | 586.50 |

| CFR Japan | 583.00 | 591.00 |

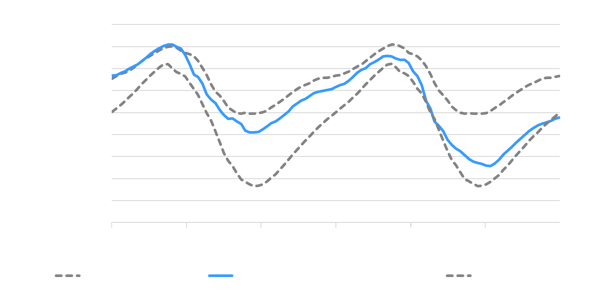

EIA US WORKING NATURAL GAS IN UNDERGROUND STORAGE

(Aug. 2016 - Aug. 2018)