| SHIPPING RATES & BUNKERS ( 9:45 am ET ) | |||

| DIRTY TANKER (KT - $/day) | VOYAGE | SPOT TCE EARNINGS | 2018 AVG. RATE |

| VLCC, 270 | AG-FE | 37,200 | 12,700 |

| Suezmax, 130 | WAF-UKC | 18,700 | 6,200 |

| Aframax, 70 | CAR-USG | 41,100 | 8,400 |

| Panamax, 50 | CAR-USG | 19,000 | 7,000 |

| CLEAN TANKER (KT - $/day) | VOYAGE | SPOT TCE EARNINGS | 2018 AVG. RATE |

| MR, 37 | UKC-USAC | 3,700 | 6,100 |

| MR, 38 | USG-UKC | 5,400 | 700 |

| TIME CHARTER (KDWT) | 1YR ECO RATE ($/day) | NEWBUILD PRICE ($M ) | SECONDHAND 5YR PRICE ($M) |

| VLCC , 200+ | 30,000 | 90.0 | 61.0 |

| Suezmax, 130-200 | 20,500 | 60.0 | 42.0 |

| Aframax, 80-130 | 17,250 | 48.0 | 29.0 |

| LR2, 80-130 | 16,500 | 50.0 | 30.0 |

| LR1, 60-80 | 13,750 | 43.0 | 26.0 |

| MR, 42-60 | 13,750 | 36.0 | 25.5 |

| Handymax. 30-42 | 12,500 | 33.0 | 23.0 |

| US FLAG (KT - $/day) | VOYAGE | WEEKLY SPOT RATE | 2018 AVG. RATE |

| Handy, 38 | USG-USAC | 56,067 | 61,220 |

| LNG ($/day) | WEEKLY SPOT RATE | CURRENT MONTH RATE | 2018 AVG. RATE |

| 160M3 Tri-fuel diesel electric (West) | 100,000 | 93,333 | 71,690 |

| 138-150M3 Steam turbine (West) | 75,000 | 70,333 | 51,000 |

| 160M3 Tri-fuel diesel electric (East) | 140,000 | 126,667 | 64,929 |

| 138-150M3 Steam turbine (East) | 90,000 | 78,333 | 43,048 |

| LPG (KT) | LAST POSTED SPOT RATE ($/mt) | SPOT TCE RATE ($/day) | 1yr TIME CHARTER RATE ($/day) |

| VLGC, 44 (AG-Japan) | 47.86 | 27,961 | 21,382 |

| BUNKERS ($/mt) | IFO 380 | MDO | |

| US Gulf | 463.5 | 744.5 | |

| Rotterdam | 471.5 | 688.0 | |

| Singapore | 516.0 | 736.5 | |

ENERGY NEWS

Saudi Arabia signs $50B worth of deals in oil, gas and infrastructure.

The deals signed on the sidelines of the Future Investment Initiative conference in Riyadh were with international companies including Trafigura, Total, Hyundai, Norinco, Schlumberger, Halliburton and Baker Hughes. Trafigura said it had signed a deal for a joint venture with Saudi's Modern Mining Holding Co. The partnership would develop a copper, zinc and lead integrated smelting and refining complex in Ras Al-Khair Mineral City, said Trafigura. Furthermore, Saudi Aramco signed agreements with 15 international partners worth more than $34B. These deals include an agreement to build an integrated petrochemical complex and downstream park in the second phase of the SATORP refinery, jointly held by Aramco and Total. It also includes investments in retail petrol stations held by Aramco and Total.

Iran oil production and exports fell after sanction announcement.

Iranian crude oil and condensate exports peaked in June at around 2.7 mbpd, more than 300,000 bpd higher than the average during the first four months of the year. In Sept. that fell to 1.9 mbpd. Volumes to China and India together accounted for about half of Iran's exports of crude and condensate in 1H 2018, averaging 644,000 bpd and 554,000 bpd respectively. Later in Sept, however, China imported 441,000 bpd, the lowest level since Dec. 2015, and India imported 576,000 bpd. Despite efforts by the European Union to protect European companies from the US sanctions, France has not imported from Iran since June while imports from Italy and Spain fell significantly.

EIA Oct. 23, 2018

US LNG cargo to arrive in China in Nov.

A cargo from Cheniere's Sabine Pass terminal is scheduled to arrive in China on Nov. 11 according to ship tracking data. This is the first cargo of US LNG scheduled to arrive in China after the government imposed a 10% tariff on US LNG as of Sept. 24.

Construction commences on 475MW Brazilian solar park.

When the Sao Goncalo facility is operating, it will have the capacity to produce more than 1,200 GWh annually, offsetting the emission of over 600,000 tons of CO2. The builder, Enel Group, described the park as the largest PV facility currently being built in South America.

| COMMODITIES, (9:30 am ET ) | ||||

| CRUDE | SOURCE | UNIT | LAST PRICE | Δ PRIOR DAY CLOSE |

| Brent | ICE | $/bbl | 77.92 | -1.91 |

| WTI | NYMEX | $/bbl | 67.73 | -1.44 |

| Dubai (Spot) | Bloomberg | $/bbl | 76.74 | -1.62 |

| PRODUCTS | SOURCE | UNIT | LAST PRICE | Δ PRIOR DAY CLOSE |

| RBOB Gasoline | NYMEX | ₵/gal | 186.00 | -4.67 |

| Heating Oil | NYMEX | ₵/gal | 227.56 | -4.25 |

| NATURAL GAS | SOURCE | UNIT | LAST PRICE | Δ PRIOR DAY CLOSE |

| US Henry Hub | NYMEX | $/MMBtu | 3.20 | +0.06 |

| UK National Balancing Point | ICE | $/MMBtu | 8.92 | -0.22 |

| NATURAL GAS LIQUIDS | SOURCE | LAST PRICE (₵/gal) | LAST PRICE ($/mt) | Δ PRIOR DAY CLOSE(₵/gal) |

| US Mont Belvieu Propane (Spot) | Bloomberg | 91.50 | 476.96 | -2.50 |

| PRICE SPREADS ($/bbl) | SOURCE | LAST PRICE | Δ PRIOR DAY CLOSE | |

| Brent 3-2-1 Crack | ICE | 6.00 | +0.02 | |

MARKETS

| MARKETS, ( 9:30 am ET ) | ||||

| EQUITIES | REGION/COUNTRY | LAST VALUE | Δ PRIOR DAY CLOSE | |

| S&P 500 | United States | 2,755.88 | -11.90 | |

| FTSE 100 | United Kingdom | 6,962.04 | -80.76 | |

| DAX | Germany | 11,256.66 | -267.68 | |

| Nikkei | Japan | 22,010.78 | -604.04 | |

| SH Composite | China | 2,594.83 | -60.05 | |

| CURRENCIES | REGION/COUNTRY | LAST VALUE | Δ PRIOR DAY CLOSE | |

| £/$ | United Kingdom | 1.30 | +0.00 | |

| €/$ | European Union | 1.15 | +0.00 | |

| $/JPY ¥ | Japan | 112.17 | -0.65 | |

| $/CNY ¥ | China | 6.94 | -0.01 | |

MARKET ANALYSIS

- Asphalt: East Coast asphalt prices slipped in many areas last week, with flux prices unchanged.

- LNG: At least seven vessels were fixed last week for single and multi-month voyages ex Far East and Middle East during Oct. and Nov.

- LPG: The East market last week was not as active as many hoped, as the delayed release of Saudi acceptances seemed to put the brakes on activity levels. The Baltic - and sentiment - stayed relatively flat as rates remained steady in the high - $40s pmt.

- Oil prices retreat as Saudi pledges to act responsibly.

EIA US LNG JULY EXPORTS, TOP 3 COUNTRIES BY DESTINATION

(Pipeline, Vessel, Truck)

| WEST OF SUEZ | (bcf/mth) | EAST OF SUEZ | (bcf/mth) | |

| Mexico (Pipeline) | 147.2 | South Korea (Vessel) | 14.0 | |

| Canada (Pipeline) | 57.5 | Japan (Vessel) | 13.4 | |

| Mexico (Vessel) | 21.2 | China (Vessel) | 10.6 | |

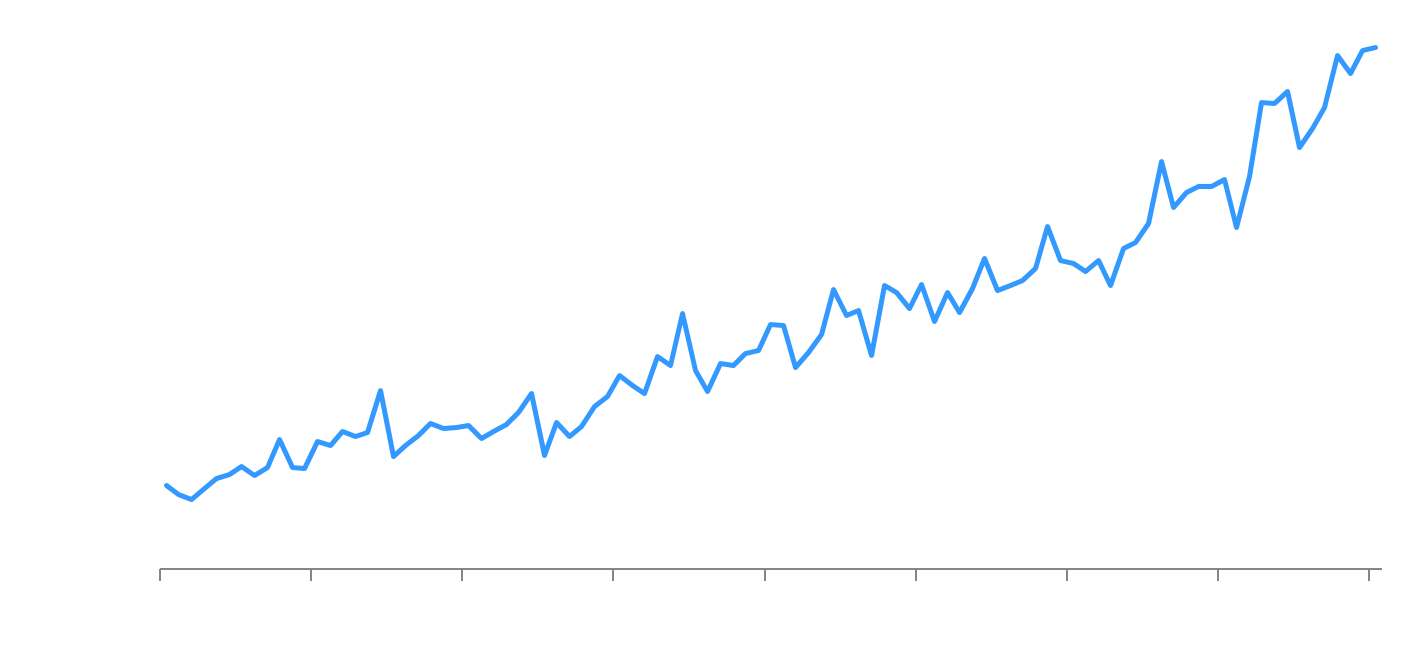

EIA US MONTHLY EXPORTS OF CRUDE OIL AND PETROLEUM PRODUCTS

July 2010 - July 2018