| SHIPPING RATES & BUNKERS ( 9:42am ET ) | |||

| DIRTY TANKER (KT - $/day) | VOYAGE | SPOT TCE EARNINGS | 2018 AVG. RATE |

| VLCC, 270 | AG-FE | 10,600 | 8,500 |

| Suezmax, 130 | WAF-UKC | 2,900 | 600 |

| Aframax, 70 | CAR-USG | 14,400 | 6,000 |

| Panamax, 50 | CAR-USG | 5,800 | 6,800 |

| CLEAN TANKER (KT - $/day) | VOYAGE | SPOT TCE EARNINGS | 2018 AVG. RATE |

| MR, 37 | UKC-USAC | 2,100 | 8,600 |

| MR, 38 | USG-UKC | (3,800) | 1,900 |

| TIME CHARTER (KDWT) | 1YR ECO RATE ($/day) | NEWBUILD PRICE ($M ) | SECONDHAND 5YR PRICE ($M) |

| VLCC , 200+ | 25,000 | 88.0 | 61.5 |

| Suezmax, 130-200 | 18,000 | 60.0 | 41.0 |

| Aframax, 80-130 | 15,000 | 48.0 | 30.0 |

| LR2, 80-130 | 15,250 | 50.0 | 30.5 |

| LR1, 60-80 | 14,000 | 42.0 | 29.0 |

| MR, 42-60 | 14,750 | 36.0 | 26.5 |

| Handymax. 30-42 | 12,750 | 33.0 | 23.0 |

| US FLAG (KT - $/day) | VOYAGE | WEEKLY SPOT RATE | 2018 AVG. RATE |

| Handy, 38 | USG-USAC | 68,077 | 64,200 |

| LNG ($/day) | WEEKLY SPOT RATE | CURRENT MONTH RATE | 2018 AVG. RATE |

| 160M3 Tri-fuel diesel electric (West) | 60,000 | 57,500 | 63,435 |

| 138-150M3 Steam turbine (West) | 43,000 | 41,500 | 42,261 |

| 160M3 Tri-fuel diesel electric (East) | 47,000 | 43,500 | 52,217 |

| 138-150M3 Steam turbine (East) | 34,000 | 32,000 | 33,522 |

| LPG (KT) | LAST POSTED SPOT RATE ($/mt) | SPOT TCE RATE ($/day) | 1yr TIME CHARTER RATE ($/day) |

| VLGC, 44 (AG-Japan) | 29.21 | 9,211 | 16,447 |

| BUNKERS ($/mt) | IFO 380 | MDO | |

| US Gulf | 420.0 | 686.0 | |

| Rotterdam | 426.0 | 644.5 | |

| Singapore | 451.0 | 667.5 | |

China’s new tax rules hit teapot refiners.

China has roughly 40 private refiners, or “teapots”, which account for one-fifth of the country’s nearly 10 mbpd in crude oil imports. Currently, they are losing both money and market share and as a result, several have shut for maintenance. The gains in gasoline retail prices have been eroded by higher costs of crude and a large consumption tax. The new tax rules resulted in teapots losing 300 yuan, or $46.80 per ton of crude oil processed. That is a sharp decline from the 900 yuan profits in early 2016. Enacted in Mar., the new rules enforce collection of $38 per bbl gasoline consumption tax and a $29 bbl tax on diesel in response to the allege use of illicit fuel invoices by many of the teapots to evade taxes. State refiners must also pay the tax, but their size relatively offsets the impact.

Chevron starts second production unit at Wheatstone LNG.

The $34B unit began producing LNG, marking the completion of Chevron's two megaprojects in Australia after rising costs and long delays. The 2nd train is the last of five LNG production units built by the major in Western Australia over the past decade, costing a total of $88B. At full capacity, Wheatstone is expected to make near 6% of Asia Pacific's LNG production, with a total capacity of 8.9 MT. Its partners in the project are Kuwait Foreign Petroleum Exploration Company (KUFPEC), Woodside Petroleum, Kyushu Electric Power Co and a JV partly owned by top buyer, Japan's JERA.

Reuters June 15, 2018

EIA sees Brent crude prices averaging $71 in 2018, $68 in 2019.

The revised 2019 average price in the latest Short-Term Energy Outlook (STEO) is $2 bbl higher than in the May (STEO). Prices have hit high levels as global inventories have generally fallen from Jan. 2017 to Apr. 2018. However, the EIA expects prices to fall in the coming months as global oil inventories are expected to rebound during 2H 2018 and 2019. Inventory is expected to grow as oil supply growth is projected to outpace forecast oil demand growth in 2019. Most of the growth in global oil production in the coming months is expected to come from the US. Meanwhile, the EIA expects OPEC production to decline in 2018 by 0.4 mbpd from 2017 levels.

Spain's Gas Natural Fenosa signs €30B supply deal with Algeria to 2030.

The company, one of Spain's largest in the energy sector, has renewed a deal to take natural gas from Algeria for another 12 years in a €30B agreement. Fenosa will be buying the gas equivalent of more than 40% of its annual gas purchases from Algeria's Sonatrach. Sonatrach owns 4% of the Spanish company.

FT June 15, 2018

| COMMODITIES, (9:42am ET ) | ||||

| CRUDE | SOURCE | UNIT | LAST PRICE | Δ PRIOR DAY CLOSE |

| Brent | ICE | $/bbl | 75.13 | -0.81 |

| WTI | NYMEX | $/bbl | 66.53 | -0.36 |

| Dubai (Spot) | Bloomberg | $/bbl | 74.33 | 0.95 |

| PRODUCTS | SOURCE | UNIT | LAST PRICE | Δ PRIOR DAY CLOSE |

| RBOB Gasoline | NYMEX | ₵/gal | 206.97 | -2.13 |

| Heating Oil | NYMEX | ₵/gal | 213.54 | -2.33 |

| NATURAL GAS | SOURCE | UNIT | LAST PRICE | Δ PRIOR DAY CLOSE |

| US Henry Hub | NYMEX | $/MMBtu | 3.00 | 0.04 |

| UK National Balancing Point | ICE | $/MMBtu | 7.36 | -0.13 |

| NATURAL GAS LIQUIDS | SOURCE | LAST PRICE (₵/gal) | LAST PRICE ($/mt) | Δ PRIOR DAY CLOSE(₵/gal) |

| US Mont Belvieu Propane (Spot) | Bloomberg | 88.75 | 462.63 | 0.25 |

| PRICE SPREADS ($/bbl) | SOURCE | LAST PRICE | Δ PRIOR DAY CLOSE | |

| Brent 3-2-1 Crack | ICE | 12.45 | -0.11 | |

| MARKETS, ( 9:42am ET ) | ||||

| EQUITIES | REGION/COUNTRY | LAST VALUE | Δ PRIOR DAY CLOSE | |

| S&P 500 | United States | 2,782.49 | 6.86 | |

| FTSE 100 | United Kingdom | 7,688.53 | -77.26 | |

| DAX | Germany | 13,017.70 | -89.40 | |

| Nikkei | Japan | 22,851.75 | 113.14 | |

| SH Composite | China | 3,021.90 | -22.26 | |

| CURRENCIES | REGION/COUNTRY | LAST VALUE | Δ PRIOR DAY CLOSE | |

| £/$ | United Kingdom | 1.33 | 0.00 | |

| €/$ | European Union | 1.16 | 0.00 | |

| $/JPY ¥ | Japan | 110.59 | -0.04 | |

| $/CNY ¥ | China | 6.43 | 0.03 | |

MARKET ANALYSIS

- Asphalt: Rockies retail price assessments climbed in most areas of the region last week.

- LNG: Near term availability continued to decrease last week, there were 11 prompt vessels across all three basins (zero in the Atlantic, 3 in the Middle East and 8 in the Far East) which is the lowest level last seen in Feb.

- LPG: Through the new Panama Canal locks, LPG carriers remain the second most frequent vessel class after container ships. Between Oct. 2017 and Mar. 2018, the Canal recorded a total 301 transits.

- Oil prices dip ahead of key OPEC meeting next week, in which the group is expected to announce a raise in production.

MAY POSTED / SPOT PRICES ($/mt)

| MAY POSTED / SPOT PRICES ($/mt) | Propane | Butane |

| Saudi Aramco | 560.00 | 560.00 |

| Sonatrach | 530.00 | 540.00 |

| OPIS North Sea | 525.00 | 516.00 |

| Spot AG | 547.50 | 554.50 |

| CFR Japan | 552.25 | 536.25 |

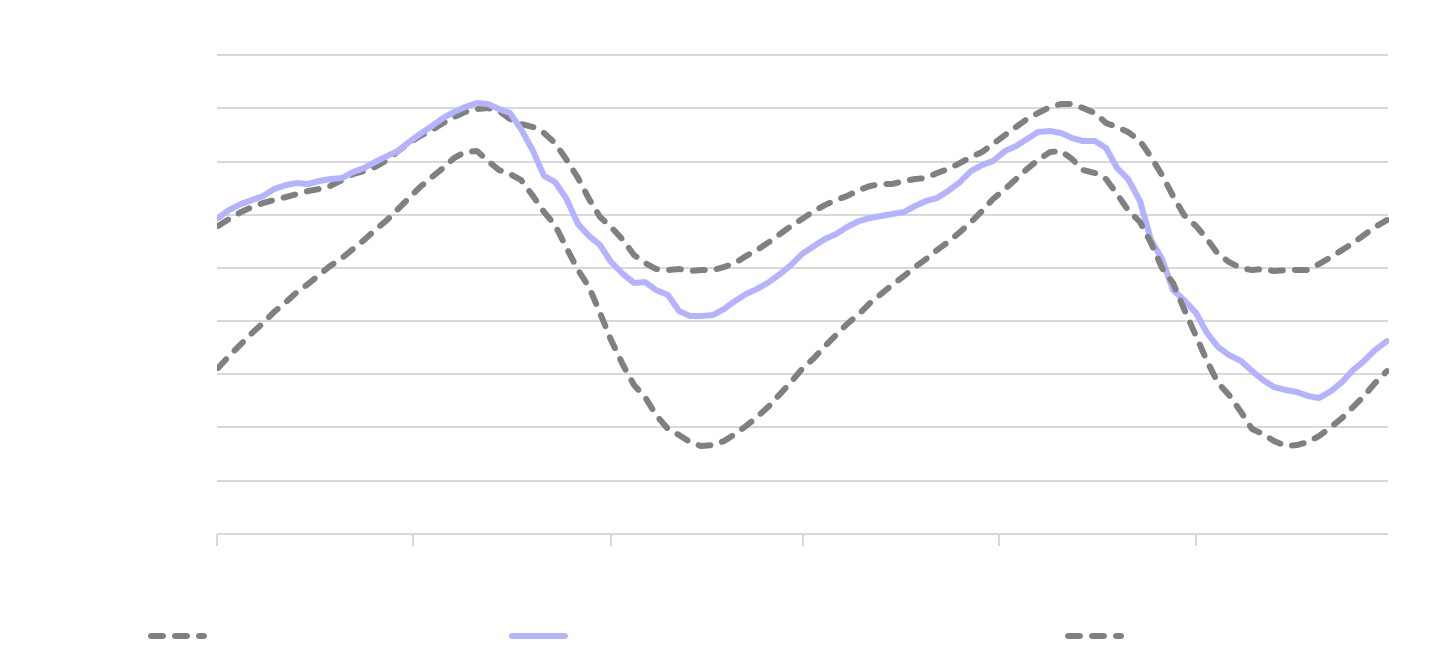

EIA US WORKING NATURAL GAS IN UNDERGROUND STORAGE

(June 2016 - June 2018)