| SHIPPING RATES & BUNKERS ( 10:30 am ET ) | |||

| DIRTY TANKER (KT - $/day) | VOYAGE | SPOT TCE EARNINGS | 2018 AVG. RATE |

| VLCC, 270 | AG-FE | 48,400 | 14,500 |

| Suezmax, 130 | WAF-UKC | 29,500 | 7,100 |

| Aframax, 70 | CAR-USG | 45,200 | 10,400 |

| Panamax, 50 | CAR-USG | 24,300 | 7,800 |

| CLEAN TANKER (KT - $/day) | VOYAGE | SPOT TCE EARNINGS | 2018 AVG. RATE |

| MR, 37 | UKC-USAC | 8,700 | 6,000 |

| MR, 38 | USG-UKC | 5,300 | 1,000 |

| TIME CHARTER (KDWT) | 1YR ECO RATE ($/day) | NEWBUILD PRICE ($M ) | SECONDHAND 5YR PRICE ($M) |

| VLCC , 200+ | 31,000 | 90.0 | 62.0 |

| Suezmax, 130-200 | 21,000 | 60.0 | 44.0 |

| Aframax, 80-130 | 17,250 | 50.0 | 30.0 |

| LR2, 80-130 | 16,750 | 52.0 | 31.0 |

| LR1, 60-80 | 13,750 | 43.0 | 26.0 |

| MR, 42-60 | 13,500 | 36.0 | 26.0 |

| Handymax. 30-42 | 12,500 | 33.0 | 23.0 |

| US FLAG (KT - $/day) | VOYAGE | WEEKLY SPOT RATE | 2018 AVG. RATE |

| Handy, 38 | USG-USAC | 56,116 | 61,074 |

| LNG ($/day) | WEEKLY SPOT RATE | CURRENT MONTH RATE | 2018 AVG. RATE |

| 160M3 Tri-fuel diesel electric (West) | 110,000 | 110,000 | 73,432 |

| 138-150M3 Steam turbine (West) | 80,000 | 80,000 | 52,318 |

| 160M3 Tri-fuel diesel electric (East) | 155,500 | 155,000 | 69,023 |

| 138-150M3 Steam turbine (East) | 105,000 | 105,000 | 45,864 |

| LPG (KT) | LAST POSTED SPOT RATE ($/mt) | SPOT TCE RATE ($/day) | 1yr TIME CHARTER RATE ($/day) |

| VLGC, 44 (AG-Japan) | 40.79 | 19,243 | 21,382 |

| BUNKERS ($/mt) | IFO 380 | MDO | |

| US Gulf | 437.0 | 716.0 | |

| Rotterdam | 443.0 | 661.5 | |

| Singapore | 514.5 | 692.0 | |

ENERGY NEWS

Iraq nears agreement with Kurds to restart oil exports from Kirkuk.

The deal, which could be reached this month, could add up to 400,000 bpd of additional oil. This could play well in constraining price hikes as Iran's crude exports fall. Crude oil prices have fallen significantly since hitting a four year peak of $86 bbl in early Oct., as traders reevaluate how much oil will be available in the market. Output from Kirkuk has been largely shut off international markets for more than a year since the Iraqi government retook the territory from Kurdistan Regional Government (KRG). The only available export outlet for the giant oilfield is KRG's own pipeline that runs to the northern border with Turkey. Baghdad has been in talks with KRG over continuing exports, but discussions have accelerated in recent weeks as Washington pressures oil producers to cover for the expected shortfall from Iran.

South Korea discusses continuing oil imports from Iran.

A delegation from South Korea, including oil buyers, is expected to travel to Iran next week to discuss resuming Iranian oil imports after a three-month pause. South Korea is one of eight countries that received waivers from the US to continue importing Iranian oil for 180 days. It can import up to 200,000 bpd of Iranian oil, mostly condensate, according to sources. Korea was the third-biggest buyer of Iranian oil and also the largest importer of its condensate, prior to Sept.

Reuters Nov. 9, 2018

US judge halts keystone XL pipeline.

This comes after a lawsuit was filed by several environmentalists against the US government after President Trump approved the project following his inauguration in 2017. The ruling said the US government did not complete a full analysis of the environmental impact of the project.

Saudi government-funded think tank studies break-up of OPEC.

This comes as the kingdom faces pressure from the US as President Trump accuses OPEC of pushing oil prices up. However, the think tank's president, Adam Sieminski, said the study had not been triggered by Trump's statements. Government officials describe the study as a high priority economic-policy inquiry and does not reflect an active debate within the government over whether to leave OPEC. An overview of the study describes two scenarios to investigate: if OPEC is not in the picture: All big oil producers, including Saudi Arabia act competitively fighting each other for market share. The second is, Saudi Arabia instead attempts to leverage its massive oil output alone to help balance the market in an attempt to keep prices stable.

| COMMODITIES, (10:30 am ET ) | ||||

| CRUDE | SOURCE | UNIT | LAST PRICE | Δ PRIOR DAY CLOSE |

| Brent | ICE | $/bbl | 69.60 | -1.05 |

| WTI | NYMEX | $/bbl | 59.67 | -1.00 |

| Dubai (Spot) | Bloomberg | $/bbl | 69.52 | -1.76 |

| PRODUCTS | SOURCE | UNIT | LAST PRICE | Δ PRIOR DAY CLOSE |

| RBOB Gasoline | NYMEX | ₵/gal | 160.55 | -3.88 |

| Heating Oil | NYMEX | ₵/gal | 212.84 | -3.99 |

| NATURAL GAS | SOURCE | UNIT | LAST PRICE | Δ PRIOR DAY CLOSE |

| US Henry Hub | NYMEX | $/MMBtu | 3.73 | +0.19 |

| UK National Balancing Point | ICE | $/MMBtu | 8.76 | +0.00 |

| NATURAL GAS LIQUIDS | SOURCE | LAST PRICE (₵/gal) | LAST PRICE ($/mt) | Δ PRIOR DAY CLOSE(₵/gal) |

| US Mont Belvieu Propane (Spot) | Bloomberg | 75.50 | 393.56 | -1.25 |

| PRICE SPREADS ($/bbl) | SOURCE | LAST PRICE | Δ PRIOR DAY CLOSE | |

| Brent 3-2-1 Crack | ICE | 4.89 | -0.50 | |

MARKETS

| MARKETS, ( 9:30 am ET ) | ||||

| EQUITIES | REGION/COUNTRY | LAST VALUE | Δ PRIOR DAY CLOSE | |

| S&P 500 | United States | 2,784.47 | -22.36 | |

| FTSE 100 | United Kingdom | 7,083.74 | -56.94 | |

| DAX | Germany | 11,505.01 | -22.31 | |

| Nikkei | Japan | 22,250.25 | -236.67 | |

| SH Composite | China | 2,598.87 | -36.76 | |

| CURRENCIES | REGION/COUNTRY | LAST VALUE | Δ PRIOR DAY CLOSE | |

| £/$ | United Kingdom | 1.30 | -0.00 | |

| €/$ | European Union | 1.14 | -0.00 | |

| $/JPY ¥ | Japan | 113.74 | -0.33 | |

| $/CNY ¥ | China | 6.96 | +0.02 | |

MARKET ANALYSIS

- Asphalt: Gulf Coast retail asphalt prices were steady last week, with flux prices slipping in some locations.

- LNG: At least 15 vessels were sitting off Singapore last week with cargo on board following tank tops in JKTC. Whilst this illustrates a drop in demand in the Far East, and the possibility of more relet vessels becoming available.

- LPG: Spot values saw further steep losses against crude and softer CP values for Nov. in NW Europe last week.

- Oil prices fall below $70 as global supplies continue to increase and investors remain concerned about lower economic growth.

NOV. POSTED / SPOT PRICES ($/mt)

| NOV. POSTED / SPOT PRICES ($/mt) | Propane | Butane |

| Saudi Aramco | 540.00 | 525.00 |

| Sonatrach | 515.00 | 515.00 |

| OPIS North Sea | 502.50 | 507.50 |

| Spot AG | 494.50 | 479.50 |

| CFR Japan | 535.50 | 533.50 |

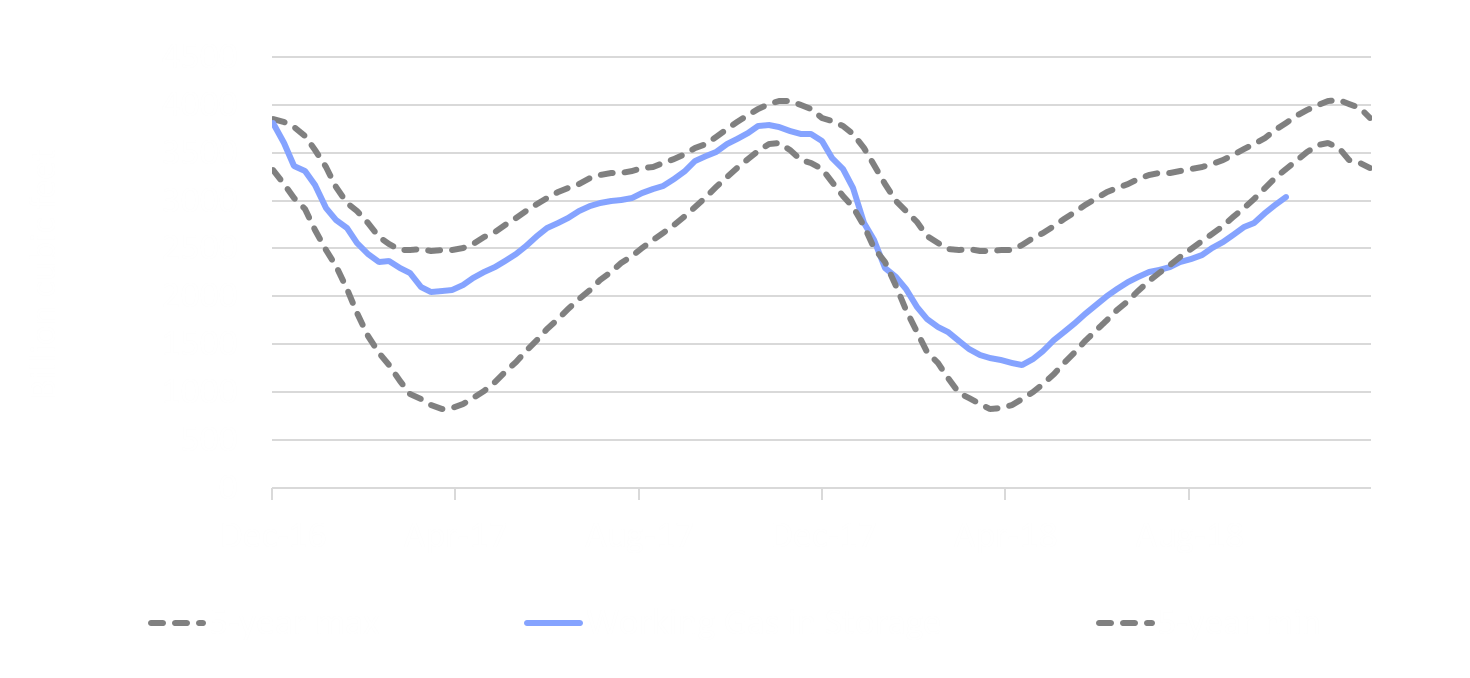

EIA US WORKING NATURAL GAS IN UNDERGROUND STORAGE

(Dec. 2016 - Dec. 2018)