| SHIPPING RATES & BUNKERS ( 9:45 am ET ) | |||

| DIRTY TANKER (KT - $/day) | VOYAGE | SPOT TCE EARNINGS | 2018 AVG. RATE |

| VLCC, 270 | AG-FE | 39,800 | 12,600 |

| Suezmax, 130 | WAF-UKC | 21,400 | 6,100 |

| Aframax, 70 | CAR-USG | 38,000 | 8,300 |

| Panamax, 50 | CAR-USG | 19,100 | 6,900 |

| CLEAN TANKER (KT - $/day) | VOYAGE | SPOT TCE EARNINGS | 2018 AVG. RATE |

| MR, 37 | UKC-USAC | 4,200 | 6,100 |

| MR, 38 | USG-UKC | 5,900 | 700 |

| TIME CHARTER (KDWT) | 1YR ECO RATE ($/day) | NEWBUILD PRICE ($M ) | SECONDHAND 5YR PRICE ($M) |

| VLCC , 200+ | 30,000 | 90.0 | 61.0 |

| Suezmax, 130-200 | 20,500 | 60.0 | 42.0 |

| Aframax, 80-130 | 17,250 | 48.0 | 29.0 |

| LR2, 80-130 | 16,500 | 50.0 | 30.0 |

| LR1, 60-80 | 13,750 | 43.0 | 26.0 |

| MR, 42-60 | 13,750 | 36.0 | 25.5 |

| Handymax. 30-42 | 12,500 | 33.0 | 23.0 |

| US FLAG (KT - $/day) | VOYAGE | WEEKLY SPOT RATE | 2018 AVG. RATE |

| Handy, 38 | USG-USAC | 56,067 | 61,220 |

| LNG ($/day) | WEEKLY SPOT RATE | CURRENT MONTH RATE | 2018 AVG. RATE |

| 160M3 Tri-fuel diesel electric (West) | 100,000 | 93,333 | 71,690 |

| 138-150M3 Steam turbine (West) | 75,000 | 70,333 | 51,000 |

| 160M3 Tri-fuel diesel electric (East) | 140,000 | 126,667 | 64,929 |

| 138-150M3 Steam turbine (East) | 90,000 | 78,333 | 43,048 |

| LPG (KT) | LAST POSTED SPOT RATE ($/mt) | SPOT TCE RATE ($/day) | 1yr TIME CHARTER RATE ($/day) |

| VLGC, 44 (AG-Japan) | 48.29 | 27,961 | 21,382 |

| BUNKERS ($/mt) | IFO 380 | MDO | |

| US Gulf | 461.0 | 747.5 | |

| Rotterdam | 466.0 | 688.0 | |

| Singapore | 513.5 | 733.5 | |

ENERGY NEWS

Germany to open up to US gas imports.

German Chancellor Angela Merkel has offered her government's support to efforts to open the country to US gas, a win for president Trump as he aims to loosen Russia's grip on Europe's largest energy market. The government will co-finance a $576M LNG shipping terminal in northern Germany, Merkel was reported saying. This will provide a big push to a project that had failed to start for years. US and German officials hope this will defuse trade disputes and possibly even end threats by Washington to sanction Nord Stream, an unbuilt German-Russian pipeline. It remains unclear, however, how much support Berlin will provide and in what form. Merkel believes the LNG terminal would not break even for at least a decade, requiring long-term government support. The German government said its decision was made in accordance with commercial interests and not US pressure.

Saudi Arabia rules out using oil as leverage in Khashoggi case.

The Saudi Energy Minister al-Falih said the kingdom is likely to raise its output close to 11 mbpd, signaling "no intention" of using its status in response to international political pressure it faces over the death of journalist Jamal Khashoggi. For decades, the country's oil policy was used as a responsible economic tool away from politics, he said in an interview. However, al-Falih insisted that the kingdom must be "appreciated and supported" for its efforts in raising oil output. With that said, he could not guarantee the kingdom could stop prices from hitting $100 bbl if more supplies were cut off the market as spare capacity thins.

FT Oct. 22, 2018

Hurricane Michael caused 1.7M electricity outages in the Southeast US.

The hurricane caused electricity outages across six states, the most were in Virginia, where peak outages reached 523,000 customers or about 14% of the state on Oct. 12. On that day, 492,000 customers in North Carolina also experienced outages, 10% of the state. As of Oct. 19, power had been restored to 93% of customers who experienced storm-related outages. Of the 125,000 customers without power as of Oct. 19, more than 80% were in Florida, where the storm made its landfall.

US says it will be harder for Iran oil importers to get waivers.

US Treasury Secretary said it will be harder for countries to receive waivers to import oil from Iran than during the Obama administration. Countries would have to reduce their purchases of Iranian oil by more than the 20% they did in 2013-2015 to get waivers. Secretary Mnuchin said that prices have already risen as the market has factored in the reductions from Iran, downplaying the possibility of a further price surge. Countries will probably not reduce their imports to zero on Nov.1, but eventually they will reach that level, he said.

| COMMODITIES, (9:45 am ET ) | ||||

| CRUDE | SOURCE | UNIT | LAST PRICE | Δ PRIOR DAY CLOSE |

| Brent | ICE | $/bbl | 79.11 | -0.67 |

| WTI | NYMEX | $/bbl | 68.32 | -0.80 |

| Dubai (Spot) | Bloomberg | $/bbl | 78.36 | +0.24 |

| PRODUCTS | SOURCE | UNIT | LAST PRICE | Δ PRIOR DAY CLOSE |

| RBOB Gasoline | NYMEX | ₵/gal | 188.21 | -3.18 |

| Heating Oil | NYMEX | ₵/gal | 229.15 | -1.05 |

| NATURAL GAS | SOURCE | UNIT | LAST PRICE | Δ PRIOR DAY CLOSE |

| US Henry Hub | NYMEX | $/MMBtu | 3.16 | -0.09 |

| UK National Balancing Point | ICE | $/MMBtu | 9.21 | -0.28 |

| NATURAL GAS LIQUIDS | SOURCE | LAST PRICE (₵/gal) | LAST PRICE ($/mt) | Δ PRIOR DAY CLOSE(₵/gal) |

| US Mont Belvieu Propane (Spot) | Bloomberg | 94.00 | 489.99 | - |

| PRICE SPREADS ($/bbl) | SOURCE | LAST PRICE | Δ PRIOR DAY CLOSE | |

| Brent 3-2-1 Crack | ICE | 5.62 | -0.18 | |

MARKETS

| MARKETS, ( 9:45 am ET ) | ||||

| EQUITIES | REGION/COUNTRY | LAST VALUE | Δ PRIOR DAY CLOSE | |

| S&P 500 | United States | 2,777.49 | -1.00 | |

| FTSE 100 | United Kingdom | 7,086.40 | +36.60 | |

| DAX | Germany | 11,594.34 | +40.51 | |

| Nikkei | Japan | 22,614.82 | +82.74 | |

| SH Composite | China | 2,654.88 | +104.41 | |

| CURRENCIES | REGION/COUNTRY | LAST VALUE | Δ PRIOR DAY CLOSE | |

| £/$ | United Kingdom | 1.30 | -0.01 | |

| €/$ | European Union | 1.15 | -0.00 | |

| $/JPY ¥ | Japan | 112.78 | +0.25 | |

| $/CNY ¥ | China | 6.94 | +0.01 | |

MARKET ANALYSIS

- LNG: At least one vessel was fixed last week for a single voyage in the Pacific in Oct.

- LPG: In the next four weeks, there are 29 spot vessels open for AG loading, 24 of which are owner tonnage and 5 are relets.

- Oil prices unmoved as traders monitor US-Saudi tensions.

- Wall street opens higher after China rally.

BAKER HUGHES DRILLING RIG COUNT

| Area | Week ended Oct. 19 | Δ Prior count | Δ Prior year |

| United States | 1,067 | 4 | 154 |

| Canada | 191 | -4 | -11 |

| International | 1,004 | -4 | 73 |

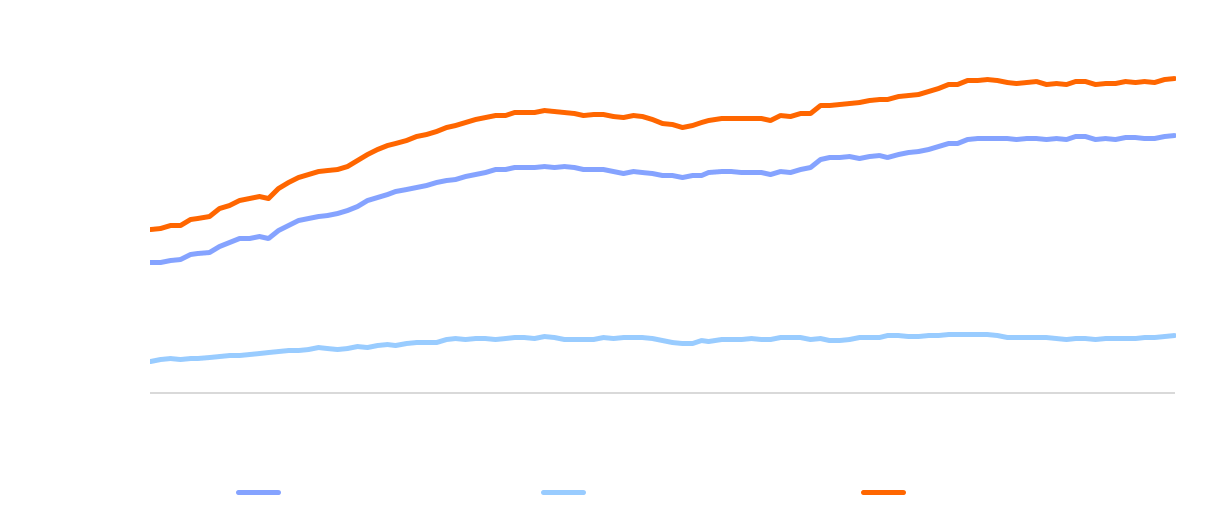

BAKER HUGHES US OIL/GAS SPLIT (Oct. 21, 2016 - Oct. 19, 2018)