| SHIPPING RATES & BUNKERS ( 9:50 am ET ) | |||

| DIRTY TANKER (KT - $/day) | VOYAGE | SPOT TCE EARNINGS | 2018 AVG. RATE |

| VLCC, 270 | AG-FE | 40,000 | 12,500 |

| Suezmax, 130 | WAF-UKC | 21,500 | 6,100 |

| Aframax, 70 | CAR-USG | 33,300 | 8,100 |

| Panamax, 50 | CAR-USG | 18,000 | 6,900 |

| CLEAN TANKER (KT - $/day) | VOYAGE | SPOT TCE EARNINGS | 2018 AVG. RATE |

| MR, 37 | UKC-USAC | 4,200 | 6,100 |

| MR, 38 | USG-UKC | 6,000 | 600 |

| TIME CHARTER (KDWT) | 1YR ECO RATE ($/day) | NEWBUILD PRICE ($M ) | SECONDHAND 5YR PRICE ($M) |

| VLCC , 200+ | 26,000 | 90.0 | 61.0 |

| Suezmax, 130-200 | 19,000 | 60.0 | 42.0 |

| Aframax, 80-130 | 16,500 | 48.0 | 29.0 |

| LR2, 80-130 | 15,250 | 50.0 | 30.0 |

| LR1, 60-80 | 13,750 | 43.0 | 26.0 |

| MR, 42-60 | 13,500 | 36.0 | 25.5 |

| Handymax. 30-42 | 12,500 | 33.0 | 23.0 |

| US FLAG (KT - $/day) | VOYAGE | WEEKLY SPOT RATE | 2018 AVG. RATE |

| Handy, 38 | USG-USAC | 56,004 | 61,220 |

| LNG ($/day) | WEEKLY SPOT RATE | CURRENT MONTH RATE | 2018 AVG. RATE |

| 160M3 Tri-fuel diesel electric (West) | 90,000 | 90,000 | 71,000 |

| 138-150M3 Steam turbine (West) | 68,000 | 68,000 | 50,415 |

| 160M3 Tri-fuel diesel electric (East) | 130,000 | 120,000 | 63,098 |

| 138-150M3 Steam turbine (East) | 75,000 | 72,500 | 41,902 |

| LPG (KT) | LAST POSTED SPOT RATE ($/mt) | SPOT TCE RATE ($/day) | 1yr TIME CHARTER RATE ($/day) |

| VLGC, 44 (AG-Japan) | 48.29 | 26,809 | 20,559 |

| BUNKERS ($/mt) | IFO 380 | MDO | |

| US Gulf | 459.0 | 742.0 | |

| Rotterdam | 461.5 | 689.0 | |

| Singapore | 509.5 | 734.5 | |

ENERGY NEWS

ADNOC to sell stake in infrastructure assets.

The state oil company is reportedly considering the sale of a stake in its multibillion-dollar pipeline infrastructure assets. The company had said it is exploring a number of "potential innovative transaction opportunities" to enhance its asset base and capital structure. The emirate is encouraging its state companies to go public with the hopes of attracting foreign investors as part of an attempt to move away from its economy's reliance on oil. However, stock market listings have slowed due to the global sell-off in equities triggered by political and economic tensions. Abu Dhabi's Mubadala postponed the listing of Cepsa following Aramco's listing delay.

Schlumberger warns of new challenges in shale industry.

The chief of the world's largest oilfield services firm has warned of emerging challenges in the US shale industry that could setback production. Mr. Kibsgaard said that in addition to the shortage of pipeline capacity that has hindered the growth in the Permian, there are now more problems that might require some forecasts of future output to be revised down. Following the slump in oil prices in 2014, the company's North American business was recovering the most strongly. However, in the three months to Sept., its revenue growth vs the rest of the world was strongest since 2014.

FT Oct. 19, 2018

Iraq transfers ownership of nine state oil companies to new National Oil Company.

The oil minister of Iraq has ordered the ownership transfer of nine state-owned oil companies, including SOMO, from the oil ministry to the new National Oil Company. This will be followed by more deals within the same framework, said the minister. The minister was appointed as the head of the new National Oil Company, which is designed to serve as an umbrella organization for state oil firms.

White House seeks to slow IMO regulation implementation.

The new rules, set to take effect on Jan. 1 2020, aim to cutback the amount of sulfur used in marine fuel. The IEA has warned that the regulation could raise demand for certain fuels, impacting across the commodity markets as well including prices for crude, diesel and other petroleum products. The White House says it is focused on the potential economical damage caused by the rise in fuel costs. However, some officials believe the timing of the implementation could have political impacts in an election next year. Nonetheless, the White House said it is not looking to withdraw from the agreement and is rejecting to characterize its plans an effort to delay implementation. Phasing in the regulation is necessary to limit the impact of fuel cost surges on consumers, said the White House.

| COMMODITIES, (9:45 am ET ) | ||||

| CRUDE | SOURCE | UNIT | LAST PRICE | Δ PRIOR DAY CLOSE |

| Brent | ICE | $/bbl | 80.24 | +0.95 |

| WTI | NYMEX | $/bbl | 69.25 | +0.60 |

| Dubai (Spot) | Bloomberg | $/bbl | 78.12 | +0.72 |

| PRODUCTS | SOURCE | UNIT | LAST PRICE | Δ PRIOR DAY CLOSE |

| RBOB Gasoline | NYMEX | ₵/gal | 192.42 | +3.31 |

| Heating Oil | NYMEX | ₵/gal | 231.64 | +2.15 |

| NATURAL GAS | SOURCE | UNIT | LAST PRICE | Δ PRIOR DAY CLOSE |

| US Henry Hub | NYMEX | $/MMBtu | 3.21 | +0.01 |

| UK National Balancing Point | ICE | $/MMBtu | 9.41 | +0.32 |

| NATURAL GAS LIQUIDS | SOURCE | LAST PRICE (₵/gal) | LAST PRICE ($/mt) | Δ PRIOR DAY CLOSE(₵/gal) |

| US Mont Belvieu Propane (Spot) | Bloomberg | 94.00 | 489.99 | -4.00 |

| PRICE SPREADS ($/bbl) | SOURCE | LAST PRICE | Δ PRIOR DAY CLOSE | |

| Brent 3-2-1 Crack | ICE | 5.97 | +0.25 | |

MARKETS

| MARKETS, ( 9:45 am ET ) | ||||

| EQUITIES | REGION/COUNTRY | LAST VALUE | Δ PRIOR DAY CLOSE | |

| S&P 500 | United States | 2,768.78 | -40.43 | |

| FTSE 100 | United Kingdom | 7,045.16 | +18.17 | |

| DAX | Germany | 11,536.20 | -53.01 | |

| Nikkei | Japan | 22,532.08 | -126.08 | |

| SH Composite | China | 2,550.47 | +64.05 | |

| CURRENCIES | REGION/COUNTRY | LAST VALUE | Δ PRIOR DAY CLOSE | |

| £/$ | United Kingdom | 1.31 | +0.00 | |

| €/$ | European Union | 1.15 | +0.00 | |

| $/JPY ¥ | Japan | 112.59 | +0.39 | |

| $/CNY ¥ | China | 6.93 | -0.01 | |

MARKET ANALYSIS

- Asphalt: West Coast prices were mixed last week- firming slightly in California and Pacific Northwest easing.

- LNG: Prompt and near-term (within the next month) tonnage continued to fall last week to new low levels, there was one prompt vessel in the Middle East and only a total of five vessels expected to be open during the coming month.

- LPG: Despite the relatively flat LPG production from refineries and gas processing plants in Argentina, a dip in domestic demand explains the increase in exports.Trump administration trade officials say they will begin trade talks with EU, UK and Japan soon.

- Oil prices rise, but are on track for a weekly loss as stocks build.

OCT. POSTED / SPOT PRICES ($/mt)

| OCT. POSTED / SPOT PRICES ($/mt) | Propane | Butane |

| Saudi Aramco | 655.00 | 655.00 |

| Sonatrach | 625.00 | 655.00 |

| OPIS North Sea | 606.00 | 650.50 |

| Spot AG | 590.00 | 580.00 |

| CFR Japan | 624.25 | 637.50 |

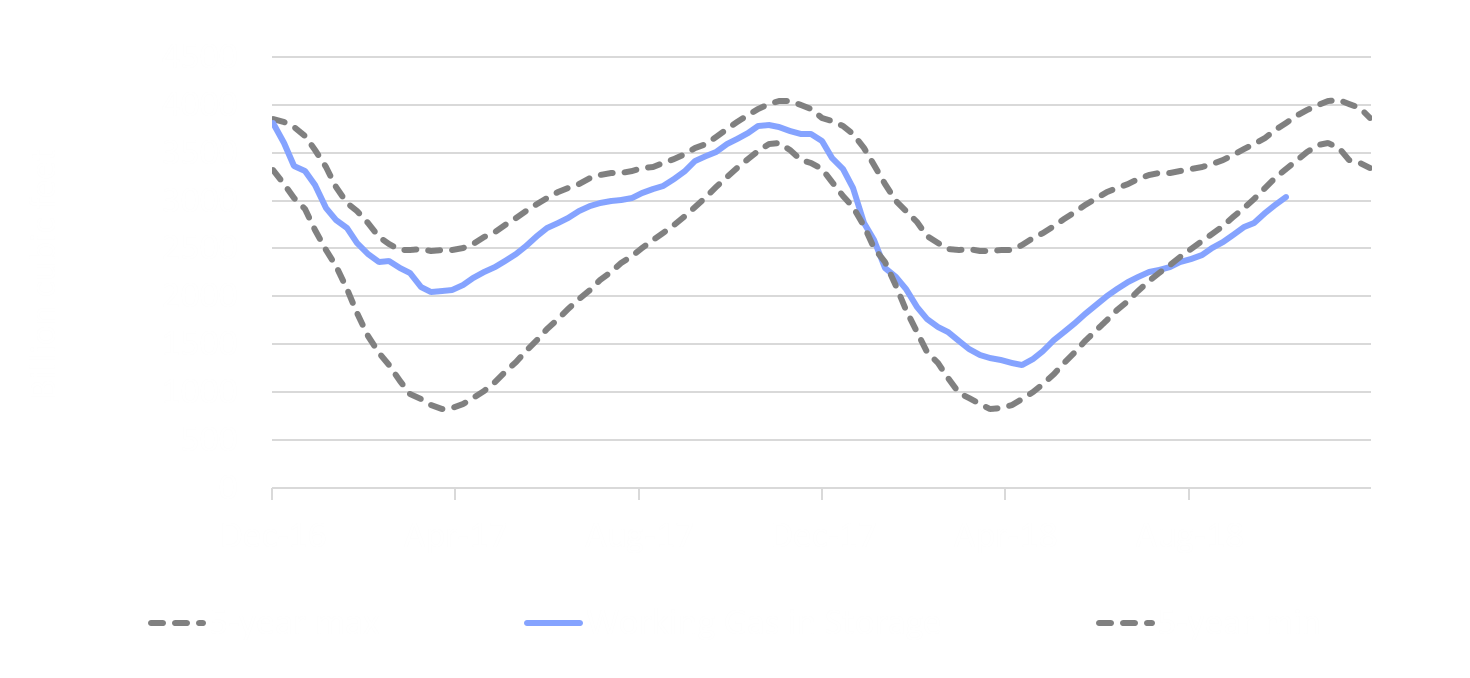

EIA US WORKING NATURAL GAS IN UNDERGROUND STORAGE

(Dec. 2016 - Dec. 2018)