| SHIPPING RATES & BUNKERS ( 10:15 am ET ) | |||

| DIRTY TANKER (KT - $/day) | VOYAGE | SPOT TCE EARNINGS | 2018 AVG. RATE |

| VLCC, 270 | AG-FE | 39,800 | 11,200 |

| Suezmax, 130 | WAF-UKC | 14,500 | 5,400 |

| Aframax, 70 | CAR-USG | 8,900 | 7,400 |

| Panamax, 50 | CAR-USG | 2,800 | 6,800 |

| CLEAN TANKER (KT - $/day) | VOYAGE | SPOT TCE EARNINGS | 2018 AVG. RATE |

| MR, 37 | UKC-USAC | 9,200 | 6,200 |

| MR, 38 | USG-UKC | (2,800) | 600 |

| TIME CHARTER (KDWT) | 1YR ECO RATE ($/day) | NEWBUILD PRICE ($M ) | SECONDHAND 5YR PRICE ($M) |

| VLCC , 200+ | 26,000 | 90.0 | 61.0 |

| Suezmax, 130-200 | 19,000 | 60.0 | 42.0 |

| Aframax, 80-130 | 16,500 | 48.0 | 29.0 |

| LR2, 80-130 | 15,250 | 50.0 | 30.0 |

| LR1, 60-80 | 13,750 | 43.0 | 26.0 |

| MR, 42-60 | 13,500 | 36.0 | 25.5 |

| Handymax. 30-42 | 12,500 | 33.0 | 23.0 |

| US FLAG (KT - $/day) | VOYAGE | WEEKLY SPOT RATE | 2018 AVG. RATE |

| Handy, 38 | USG-USAC | 55,988 | 61,479 |

| LNG ($/day) | WEEKLY SPOT RATE | CURRENT MONTH RATE | 2018 AVG. RATE |

| 160M3 Tri-fuel diesel electric (West) | 90,000 | 91,500 | 70,026 |

| 138-150M3 Steam turbine (West) | 68,000 | 68,000 | 49,213 |

| 160M3 Tri-fuel diesel electric (East) | 10,000 | 90,750 | 60,179 |

| 138-150M3 Steam turbine (East) | 65,000 | 63,750 | 40,333 |

| LPG (KT) | LAST POSTED SPOT RATE ($/mt) | SPOT TCE RATE ($/day) | 1yr TIME CHARTER RATE ($/day) |

| VLGC, 44 (AG-Japan) | 47.96 | 27,467 | 19,737 |

| BUNKERS ($/mt) | IFO 380 | MDO | |

| US Gulf | 478.5 | 765.0 | |

| Rotterdam | 480.5 | 706.0 | |

| Singapore | 523.5 | 757.5 | |

ENERGY NEWS

India is reportedly buying 9 mb of Iranian oil in Nov.

The world's third biggest oil importer is reportedly continuing to buy oil from Iran despite the US sanctions beginning on Nov. 4. Indian Oil Corp will take 6 mb of Iranian oil and Mangalore Refinery and Petrochemicals Ltd will lift 3 mb. Meanwhile, the US is imposing new sanctions on the Isalmic Republic with the aim to halt the country's crude exports.

Cuadrilla to begin fracking for gas in England next week.

The Shale gas developer will start fracking for gas at its Preston New Road site in northwest England as early as next week. Fracking was stopped in Britain seven years ago after causing earth tremors. However, the regulation is being relaxed as the British government moves to reduce its reliance on imports which have risen to more than 50% of British gas supplies. Shale gas resources in northern England alone are estimated to amount to 1,300 Tcf of gas, 10% of which could meet the country's demand for almost 40 years. The decision to allow Cuadrilla to frack has been met with opposition by protestors.

Reuters Oct. 5, 2018

US purchases of Venezuelan oil rose in Sept., driven by Citgo, Valero.

Venezuela's Sept. crude sales to the US were their highest in over a year as Citgo Petroleum and Valero Energy boost their purchases. Also, a collision in Aug. at a dock of Venezuela's main oil port obstructed exports to Asia. This led to a boost for medium-sized tankers which include those typically covering routes to the US. The US imported 601,505 bpd of Venezuelan crude last month, a 28% increase compared to Aug. Of that, Valero and Citgo bought over 250,000 bpd last month, compared with an average of 170,00 bpd earlier this year.

IEA sees petrochemicals driving oil demand growth.

According to the International Energy Agency, petrochemicals are quickly advancing ahead of trucks, aviation and shipping as the biggest driver of global oil consumption, accounting for more than a third of the growth by 2030. This comes as transportation vehicles become less aggressive consumers, thanks to increased efficiency, alternative fuels and electrification. The chemicals products sector is growing quickly and is expected to account for nearly half of oil demand growth by 2050. Specifically, the plastics segment is the fastest-growing group of bulk materials in the world. However, there has been mounting environmental concerns over plastics pollution in oceans. But without significant improvements in waste management policies, the quantity of plastic waste will continue to rise, said the IEA chief. In addition, plastic consumption in emerging economies will likely outweigh any reduced usage, leading to robust oil demand.

| COMMODITIES, (9:45 am ET ) | ||||

| CRUDE | SOURCE | UNIT | LAST PRICE | Δ PRIOR DAY CLOSE |

| Brent | ICE | $/bbl | 84.28 | -0.30 |

| WTI | NYMEX | $/bbl | 74.19 | -0.14 |

| Dubai (Spot) | Bloomberg | $/bbl | 83.14 | -1.08 |

| PRODUCTS | SOURCE | UNIT | LAST PRICE | Δ PRIOR DAY CLOSE |

| RBOB Gasoline | NYMEX | ₵/gal | 209.21 | -0.83 |

| Heating Oil | NYMEX | ₵/gal | 239.42 | -0.55 |

| NATURAL GAS | SOURCE | UNIT | LAST PRICE | Δ PRIOR DAY CLOSE |

| US Henry Hub | NYMEX | $/MMBtu | 3.20 | +0.03 |

| UK National Balancing Point | ICE | $/MMBtu | 9.76 | +0.06 |

| NATURAL GAS LIQUIDS | SOURCE | LAST PRICE (₵/gal) | LAST PRICE ($/mt) | Δ PRIOR DAY CLOSE(₵/gal) |

| US Mont Belvieu Propane (Spot) | Bloomberg | 102.75 | 535.60 | -3.25 |

| PRICE SPREADS ($/bbl) | SOURCE | LAST PRICE | Δ PRIOR DAY CLOSE | |

| Brent 3-2-1 Crack | ICE | 7.76 | -0.01 | |

MARKETS

| MARKETS, ( 9:45 am ET ) | ||||

| EQUITIES | REGION/COUNTRY | LAST VALUE | Δ PRIOR DAY CLOSE | |

| S&P 500 | United States | 2,901.61 | -23.90 | |

| FTSE 100 | United Kingdom | 7,331.94 | -86.40 | |

| DAX | Germany | 12,130.33 | -113.81 | |

| Nikkei | Japan | 23,783.72 | -191.90 | |

| SH Composite | China | 2,821.35 | - | |

| CURRENCIES | REGION/COUNTRY | LAST VALUE | Δ PRIOR DAY CLOSE | |

| £/$ | United Kingdom | 1.31 | +0.01 | |

| €/$ | European Union | 1.15 | +0.00 | |

| $/JPY ¥ | Japan | 113.89 | -0.02 | |

| $/CNY ¥ | China | 6.87 | - | |

MARKET ANALYSIS

- Asphalt: The Gulf Coast asphalt barge range softened last week, with the flux barge ranges flat.

- LNG: Prompt tonnage remained at low levels last week with 5 vessels prompt worldwide, 2 in the Far East, 3 in the Atlantic and none in the in the Middle East.

- LPG: Activity in the Middle East FOB market picked up last week as Qatar Petroleum awarded their Oct. loading tender and at least two spot sales were reported.

- Oil prices rise on upcoming Iran sanctions, uncertain outlook.

- Unemployment falls to 3.7%.

SEPT. POSTED / SPOT PRICES ($/mt)

| SEPT. POSTED / SPOT PRICES ($/mt) | Propane | Butane |

| Saudi Aramco | 600.00 | 635.00 |

| Sonatrach | 585.00 | 605.00 |

| OPIS North Sea | 574.00 | 590.00 |

| Spot AG | 637.50 | 652.50 |

| CFR Japan | 669.50 | 687.50 |

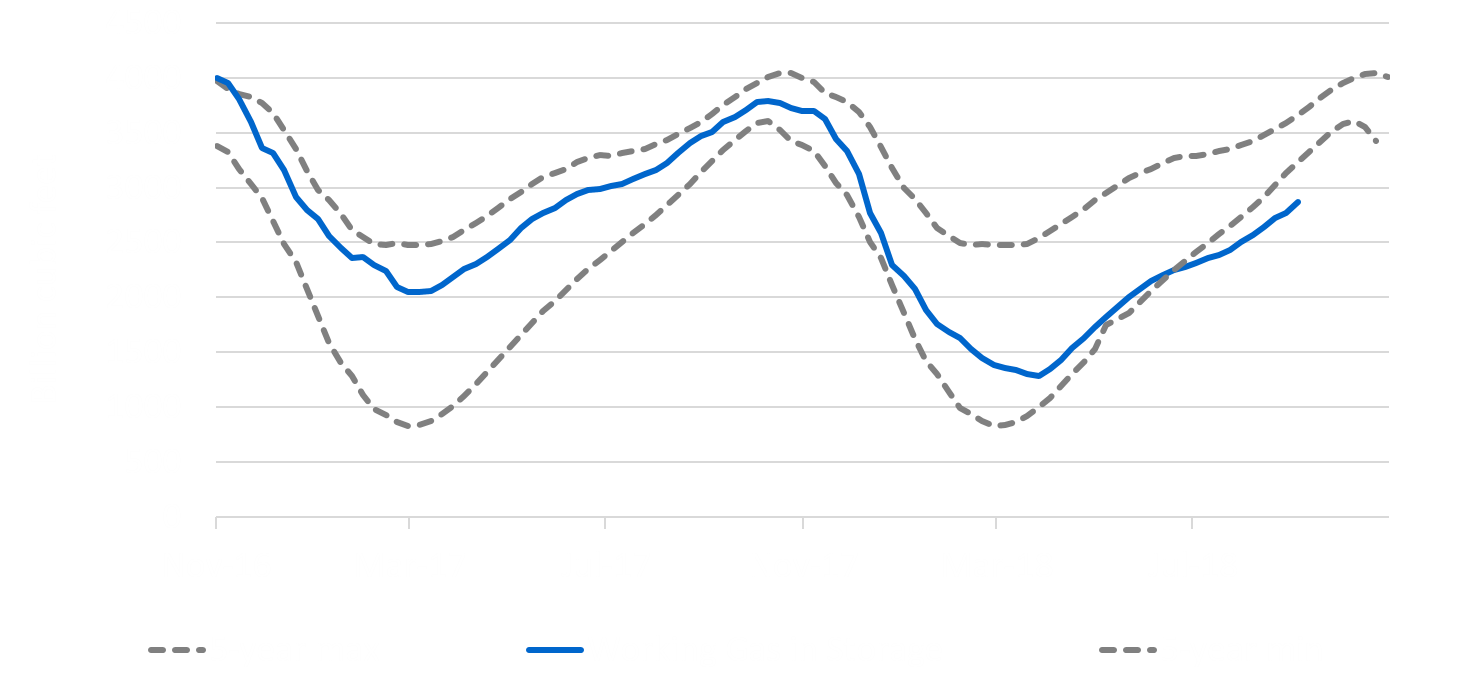

EIA US WORKING NATURAL GAS IN UNDERGROUND STORAGE

(Nov. 2016 - Nov. 2018)