| SHIPPING RATES & BUNKERS ( 9:40 am ET ) | |||

| DIRTY TANKER (KT - $/day) | VOYAGE | SPOT TCE EARNINGS | 2018 AVG. RATE |

| VLCC, 270 | AG-FE | 17,000 | 10,600 |

| Suezmax, 130 | WAF-UKC | 7,100 | 5,200 |

| Aframax, 70 | CAR-USG | 18,400 | 7,100 |

| Panamax, 50 | CAR-USG | 9,100 | 6,800 |

| CLEAN TANKER (KT - $/day) | VOYAGE | SPOT TCE EARNINGS | 2018 AVG. RATE |

| MR, 37 | UKC-USAC | 200 | 6,300 |

| MR, 38 | USG-UKC | 1,200 | 700 |

| TIME CHARTER (KDWT) | 1YR ECO RATE ($/day) | NEWBUILD PRICE ($M ) | SECONDHAND 5YR PRICE ($M) |

| VLCC , 200+ | 26,000 | 90.0 | 61.0 |

| Suezmax, 130-200 | 19,000 | 60.0 | 42.0 |

| Aframax, 80-130 | 16,500 | 48.0 | 29.0 |

| LR2, 80-130 | 15,500 | 50.0 | 30.0 |

| LR1, 60-80 | 13,750 | 43.0 | 26.0 |

| MR, 42-60 | 13,500 | 36.0 | 25.5 |

| Handymax. 30-42 | 12,500 | 33.0 | 23.0 |

| US FLAG (KT - $/day) | VOYAGE | WEEKLY SPOT RATE | 2018 AVG. RATE |

| Handy, 38 | USG-USAC | 56,014 | 61,768 |

| LNG ($/day) | WEEKLY SPOT RATE | CURRENT MONTH RATE | 2018 AVG. RATE |

| 160M3 Tri-fuel diesel electric (West) | 95,000 | 92,000 | 69,500 |

| 138-150M3 Steam turbine (West) | 68,000 | 68,000 | 49,026 |

| 160M3 Tri-fuel diesel electric (East) | 95,000 | 87,667 | 59,132 |

| 138-150M3 Steam turbine (East) | 65,000 | 63,333 | 39,684 |

| LPG (KT) | LAST POSTED SPOT RATE ($/mt) | SPOT TCE RATE ($/day) | 1yr TIME CHARTER RATE ($/day) |

| VLGC, 44 (AG-Japan) | 46.57 | 27,303 | 18,421 |

| BUNKERS ($/mt) | IFO 380 | MDO | |

| US Gulf | 437.5 | 711.0 | |

| Rotterdam | 435.5 | 658.0 | |

| Singapore | 478.0 | 709.5 | |

ENERGY NEWS

Crude oil was the largest US petroleum export in 1H 2018.

Crude volumes out of the US surpassed hydrocarbon gas liquids (HGL) with 1.8 mbpd in 1H 2018. This marks an increase of 787,000 bpd, or around 80%, from 1H 2017 to 1H 2018. Much of this crude was destined to Asia and Oceania with Europe being the second-largest market for US crude exports led by Italy, the UK and the Netherlands. Meanwhile, volumes to Canada were slightly lower in 1H 2018 compared with the same period in 2017. In total, the US exported 7.3 mbpd of crude oil and petroleum products in 1H 2018, the largest amount of crude oil and petroleum product exports ever for the first six months of a year.

French giant Total makes major UK gas discovery.

The energy group said preliminary tests on the new gas discovery off the coast of the Shetland islands in the North Sea confirmed good reservoir quality, permeability and well production deliverability with recoverable resources estimated at about 1 Tcf. The discovery will be tied back to the existing infrastructure and developed quickly at a low cost, said Total.

Reuters Sept. 24, 2018

Saudi Aramco Trading seeks 50% increase in trade volume in 2020.

Aramco Trading Company (ATC) expects to increase its oil trading volume to 6 mbpd in 2020, 50% higher than current levels. The company is considering building its capacity in trading LNG, using its Singapore office as a trading hub. ATC also expects to benefit from a switch by ships to cleaner fuels in 2020 as mandated by the IMO.

Iranian crude oil exports pressured by sanctions.

Although the start of the sanctions is still more than a month away, Iranian oil sales are already being impacted. According to Lloyd's list Intelligence data, Iran exported an average of 2.35 mbpd by tankers in the first 5 months of 2018. In August, seaborne exports fell to an estimated 1.77 mbpd. Korea has stopped all imports from Iran, which account for about half the reduction in Iranian exports. India imported about 180,000 bpd less crude from Iran in Aug., compared to the average imports in the prior three months, which were unusually high. Iranian exports to China, which had been averaging around 672,000 bpd over the first 7 months of the year, amounted to only 574,000 bpd in Aug. In addition, many companies in Europe are cutting imports from Iran, even though some European governments would prefer to continue trading with Iran. On the supply side, Saudi Arabia is seen as the likely replacement of Iranian oil as it has spare capacity that could be brought to market quickly. So far, the sanctions have not had a strong impact on the tanker market. A switch from Iran to Saudi Arabia does little for ton-mile demand. More US crude oil exports could be helpful, but this will be delayed due to logistical bottlenecks.

| COMMODITIES, (9:25 am ET ) | ||||

| CRUDE | SOURCE | UNIT | LAST PRICE | Δ PRIOR DAY CLOSE |

| Brent | ICE | $/bbl | 80.54 | +1.74 |

| WTI | NYMEX | $/bbl | 72.28 | +1.50 |

| Dubai (Spot) | Bloomberg | $/bbl | 78.65 | +1.53 |

| PRODUCTS | SOURCE | UNIT | LAST PRICE | Δ PRIOR DAY CLOSE |

| RBOB Gasoline | NYMEX | ₵/gal | 204.68 | +2.97 |

| Heating Oil | NYMEX | ₵/gal | 226.72 | +4.12 |

| NATURAL GAS | SOURCE | UNIT | LAST PRICE | Δ PRIOR DAY CLOSE |

| US Henry Hub | NYMEX | $/MMBtu | 2.99 | +0.02 |

| UK National Balancing Point | ICE | $/MMBtu | 10.38 | +0.38 |

| NATURAL GAS LIQUIDS | SOURCE | LAST PRICE (₵/gal) | LAST PRICE ($/mt) | Δ PRIOR DAY CLOSE(₵/gal) |

| US Mont Belvieu Propane (Spot) | Bloomberg | 104.13 | 542.80 | +0.38 |

| PRICE SPREADS ($/bbl) | SOURCE | LAST PRICE | Δ PRIOR DAY CLOSE | |

| Brent 3-2-1 Crack | ICE | 8.19 | -0.17 | |

MARKETS

| MARKETS, ( 9:25 am ET ) | ||||

| EQUITIES | REGION/COUNTRY | LAST VALUE | Δ PRIOR DAY CLOSE | |

| S&P 500 | United States | 2,929.67 | -1.08 | |

| FTSE 100 | United Kingdom | 7,467.98 | -22.25 | |

| DAX | Germany | 12,376.80 | -54.08 | |

| Nikkei | Japan | 23,869.93 | +195.00 | |

| SH Composite | China | 2,797.49 | +68.24 | |

| CURRENCIES | REGION/COUNTRY | LAST VALUE | Δ PRIOR DAY CLOSE | |

| £/$ | United Kingdom | 1.32 | +0.01 | |

| €/$ | European Union | 1.18 | +0.01 | |

| $/JPY ¥ | Japan | 112.63 | +0.05 | |

| $/CNY ¥ | China | 6.86 | +0.01 | |

MARKET ANALYSIS

- LNG: At least two vessels were fixed last week, both for loadings ex Far East in Oct.

- LPG: In the next four weeks, there are 24 spot vessels open for AG loading, 21 of which are owner tonnage and 3 are relets.

- Oil prices climb near 4-year highs as OPEC and Russia dismiss any immediate increase in production despite Trump's calls for lower prices.

BAKER HUGHES DRILLING RIG COUNT

| Area | Week ended Sept. 21 | Δ Prior count | Δ Prior year |

| United States | 1,053 | -2 | 118 |

| Canada | 197 | -29 | -23 |

| International | 1,008 | 11 | 56 |

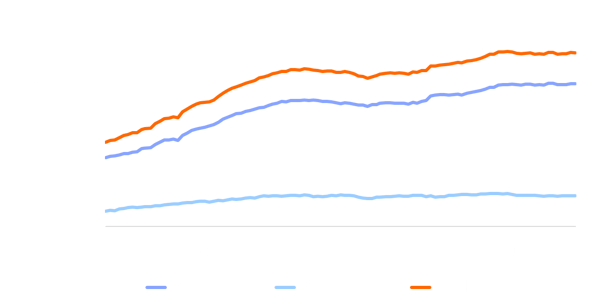

BAKER HUGHES US OIL/GAS SPLIT

(Sept. 23, 2016 - Sept. 24, 2018)