| SHIPPING RATES & BUNKERS ( 9:30 am ET ) | |||

| DIRTY TANKER (KT - $/day) | VOYAGE | SPOT TCE EARNINGS | 2018 AVG. RATE |

| VLCC, 270 | AG-FE | 12,600 | 9,700 |

| Suezmax, 130 | WAF-UKC | 4,500 | 5,100 |

| Aframax, 70 | CAR-USG | 1,300 | 5,700 |

| Panamax, 50 | CAR-USG | 7,700 | 6,400 |

| CLEAN TANKER (KT - $/day) | VOYAGE | SPOT TCE EARNINGS | 2018 AVG. RATE |

| MR, 37 | UKC-USAC | 4,000 | 6,800 |

| MR, 38 | USG-UKC | (2,600) | 800 |

| TIME CHARTER (KDWT) | 1YR ECO RATE ($/day) | NEWBUILD PRICE ($M ) | SECONDHAND 5YR PRICE ($M) |

| VLCC , 200+ | 26,000 | 90.0 | 61.0 |

| Suezmax, 130-200 | 19,000 | 60.0 | 42.0 |

| Aframax, 80-130 | 16,000 | 48.0 | 30.0 |

| LR2, 80-130 | 16,000 | 50.0 | 31.0 |

| LR1, 60-80 | 13,750 | 43.0 | 26.0 |

| MR, 42-60 | 13,750 | 35.5 | 25.5 |

| Handymax. 30-42 | 12,500 | 33.0 | 23.0 |

| US FLAG (KT - $/day) | VOYAGE | WEEKLY SPOT RATE | 2018 AVG. RATE |

| Handy, 38 | USG-USAC | 58,070 | 62,786 |

| LNG ($/day) | WEEKLY SPOT RATE | CURRENT MONTH RATE | 2018 AVG. RATE |

| 160M3 Tri-fuel diesel electric (West) | 74,000 | 74,000 | 66,688 |

| 138-150M3 Steam turbine (West) | 56,000 | 56,000 | 46,406 |

| 160M3 Tri-fuel diesel electric (East) | 63,000 | 63,000 | 55,719 |

| 138-150M3 Steam turbine (East) | 44,000 | 44,000 | 36,813 |

| LPG (KT) | LAST POSTED SPOT RATE ($/mt) | SPOT TCE RATE ($/day) | 1yr TIME CHARTER RATE ($/day) |

| VLGC, 44 (AG-Japan) | 39.79 | 20,559 | 17,270 |

| BUNKERS ($/mt) | IFO 380 | MDO | |

| US Gulf | 419.5 | 727.0 | |

| Rotterdam | 422.5 | 622.0 | |

| Singapore | 467.5 | 658.0 | |

ENERGY NEWS

Saudi Arabia cuts oil production, despite pledge to boost output.

The kingdom's oil production in July fell even though it has promised to raise output significantly in an effort to offset an expected drop in Iranian exports. Last month, Saudi Arabia pumped just below 10.4 mbpd, according to OPEC research figures. This is equivalent to a fall back of more than 52,000 bpd from the previous month. Figures from the kingdom itself showed an even lower number, below 10.3 mbpd. President Trump had asked global producers to supply more oil after the launch of US sanctions on Iran's oil sector to keep oil prices steady. OPEC's largest producer said it lowered production because it has not seen sufficient demand for its crude as Iran offers heavy discounts for its crude. Nonetheless, total OPEC production was 32.3 mbpd, up 41,000 bpd from the prior report.

Iraq strikes $369M deal with Petrofac to build Majnoon crude-processing plant.

The deal terms state that work to build the new facility, which has a capacity to produce 200,000 bpd should be completed in 34 months.

Reuters Aug 13, 2018

Caspian countries to settle dispute on oil and gas reserves.

Leaders of Russia, Kazakhstan, Iran, Azerbaijan and Turkmenistan struck a deal that aims to resolve a longstanding dispute over ownership of O&G reserves on the water. According to the EIA, Caspian reserves of 2012 were estimated at 48B bbl of oil and 292 Tcf of natural gas. Details of the deal were not revealed, but an early draft of the agreement outlined key provisions. These include defining and regulating the "rights and obligations of each of the countries with respect to the use of the Caspian sea waters, bottom, subsoil, natural resources and airspace". It also established that territorial waters not exceed 15 nautical miles in width.

Multiple VLCC export terminals planned offshore US Gulf.

Since 2017, as US production grew, Asia has developed into an important destination for US crude and VLCCs have become a more significant factor in the transportation mix. In 1H 2018, VLCCs carried a higher percentage of US Gulf crude oil exports than Aframaxes and Suezmaxes, even though almost all VLCCs in the USG need to be loaded via reverse lightering. As a result, several midstream, logistics and trading companies have announced plans for VLCC capable offshore export terminals. The projects that have been announced so far are located all over the USG coast area, from Brownville in the south-west corner of Texas to LOOP in eastern Louisiana. Even if not all these offshore terminals are built, VLCC export capacity from the USG will likely grow dramatically in the next 3-4 years, coinciding with and facilitating a rapid expansion of US production.

| COMMODITIES, (9:10 am ET ) | ||||

| CRUDE | SOURCE | UNIT | LAST PRICE | Δ PRIOR DAY CLOSE |

| Brent | ICE | $/bbl | 72.82 | 0.01 |

| WTI | NYMEX | $/bbl | 67.40 | -0.23 |

| Dubai (Spot) | Bloomberg | $/bbl | 71.59 | 0.85 |

| PRODUCTS | SOURCE | UNIT | LAST PRICE | Δ PRIOR DAY CLOSE |

| RBOB Gasoline | NYMEX | ₵/gal | 203.61 | -0.31 |

| Heating Oil | NYMEX | ₵/gal | 214.36 | 0.39 |

| NATURAL GAS | SOURCE | UNIT | LAST PRICE | Δ PRIOR DAY CLOSE |

| US Henry Hub | NYMEX | $/MMBtu | 2.92 | -0.02 |

| UK National Balancing Point | ICE | $/MMBtu | 7.90 | 0.20 |

| NATURAL GAS LIQUIDS | SOURCE | LAST PRICE (₵/gal) | LAST PRICE ($/mt) | Δ PRIOR DAY CLOSE(₵/gal) |

| US Mont Belvieu Propane (Spot) | Bloomberg | 96.88 | 505.01 | -0.12 |

| PRICE SPREADS ($/bbl) | SOURCE | LAST PRICE | Δ PRIOR DAY CLOSE | |

| Brent 3-2-1 Crack | ICE | 11.14 | 0.08 | |

MARKETS

| MARKETS, ( 9:10 am ET ) | ||||

| EQUITIES | REGION/COUNTRY | LAST VALUE | Δ PRIOR DAY CLOSE | |

| S&P 500 | United States | 2,833.28 | -20.30 | |

| FTSE 100 | United Kingdom | 7,638.67 | -28.34 | |

| DAX | Germany | 12,371.97 | -52.38 | |

| Nikkei | Japan | 21,857.43 | -440.65 | |

| SH Composite | China | 2,785.87 | -9.44 | |

| CURRENCIES | REGION/COUNTRY | LAST VALUE | Δ PRIOR DAY CLOSE | |

| £/$ | United Kingdom | 1.28 | 0.00 | |

| €/$ | European Union | 1.14 | 0.00 | |

| $/JPY ¥ | Japan | 110.77 | -0.05 | |

| $/CNY ¥ | China | 6.88 | 0.04 | |

MARKET ANALYSIS

- LNG: At least three vessels were fixed last week, for single voyages loading Atlantic and SE Asia in Aug and Sept.

- LPG: In the next four weeks, there are 15 spot vessels open for AG loading, 13 of which are owner tonnage and 2 are relets.

- US stock futures drop on worries on Turkey currency crisis.

- Turkish lira falls further, hits fresh lows against US dollar.

BAKER HUGHES DRILLING RIG COUNT

| Area | Week ended Aug 10 | Δ Prior count | Δ Prior year |

| United States | 1,057 | 13 | 108 |

| Canada | 209 | -14 | -11 |

| International | 997 | 38 | 38 |

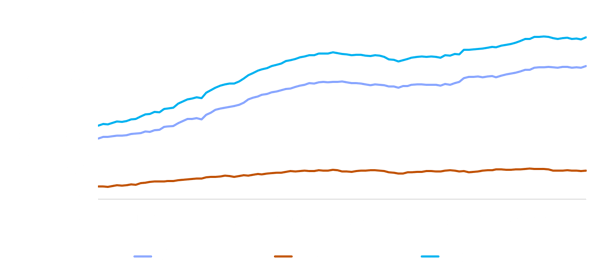

BAKER HUGHES US OIL/GAS SPLIT

(Aug 12, 2016 - Aug 10, 2018)