| SHIPPING RATES & BUNKERS ( 9:50 am ET ) | |||

| DIRTY TANKER (KT - $/day) | VOYAGE | SPOT TCE EARNINGS | 2018 AVG. RATE |

| VLCC, 270 | AG-FE | 9,100 | 9,300 |

| Suezmax, 130 | WAF-UKC | 6,700 | 4,900 |

| Aframax, 70 | CAR-USG | 1,300 | 6,300 |

| Panamax, 50 | CAR-USG | 5,300 | 6,600 |

| CLEAN TANKER (KT - $/day) | VOYAGE | SPOT TCE EARNINGS | 2018 AVG. RATE |

| MR, 37 | UKC-USAC | 400 | 7,600 |

| MR, 38 | USG-UKC | (600) | 1,300 |

| TIME CHARTER (KDWT) | 1YR ECO RATE ($/day) | NEWBUILD PRICE ($M ) | SECONDHAND 5YR PRICE ($M) |

| VLCC , 200+ | 26,000 | 88.0 | 62.0 |

| Suezmax, 130-200 | 17,750 | 60.0 | 42.0 |

| Aframax, 80-130 | 16,500 | 48.0 | 30.0 |

| LR2, 80-130 | 16,000 | 50.0 | 31.0 |

| LR1, 60-80 | 13,750 | 42.0 | 28.0 |

| MR, 42-60 | 13,500 | 35.5 | 26.5 |

| Handymax. 30-42 | 12,750 | 33.0 | 23.0 |

| US FLAG (KT - $/day) | VOYAGE | WEEKLY SPOT RATE | 2018 AVG. RATE |

| Handy, 38 | USG-USAC | 58,079 | 63,606 |

| LNG ($/day) | WEEKLY SPOT RATE | CURRENT MONTH RATE | 2018 AVG. RATE |

| 160M3 Tri-fuel diesel electric (West) | 76,000 | 76,000 | 65,571 |

| 138-150M3 Steam turbine (West) | 58,000 | 58,000 | 44,964 |

| 160M3 Tri-fuel diesel electric (East) | 65,000 | 65,000 | 54,607 |

| 138-150M3 Steam turbine (East) | 45,000 | 45,000 | 35,750 |

| LPG (KT) | LAST POSTED SPOT RATE ($/mt) | SPOT TCE RATE ($/day) | 1yr TIME CHARTER RATE ($/day) |

| VLGC, 44 (AG-Japan) | 36.75 | 17,105 | 16,447 |

| BUNKERS ($/mt) | IFO 380 | MDO | |

| US Gulf | 443.0 | 676.5 | |

| Rotterdam | 432.0 | 631.0 | |

| Singapore | 462.5 | 656.0 | |

ENERGY NEWS

US refinery capacity virtually unchanged between 2017-2018.

As of Jan. 1, 2018, US operable atmospheric crude distillation capacity totaled 18.6 mb per calendar day, 0.1% lower than 2017. Annual operable crude oil distillation unit (CDU) capacity had increased slightly in each of the five years before 2018. Barrels per calendar day reflect the input a distillation unit can process in a 24-hour period under usual operating conditions, taking into account both planned and unplanned maintenance. Meanwhile, secondary refining capacity including thermal cracking, catalytic hydrocracking, increased 1% from year-ago levels. Record refinery runs have contributed to increased US production, which averaged 9.4 mbpd in 2017, a 4 mbpd jump from 2009 levels.

China’s economy expected to fall further, global growth likely impacted.

Data released since Friday confirms that the ongoing effort to reduce credit is slowing China’s economic growth. As the country contributes as much as one-third of global growth, this is a sign that the world economy may experience a slowdown in the coming years. China’s economy grew at an expected 6.7% in 2Q, it’s slowest pace since 2016, while indicators for investment growth and industrial output slowed in June. Retail sales remained stable. If the US pursues its tariffs on as much as $250B worth of Chinese imports, this could reduce the latter’s growth by 0.3%. The risk of an indirect hit to China from supply chain complexities could result in another 0.3% drop.

Bloomberg July 16, 2018

Germany says Nord Stream 2 pipeline is a commercial project.

This comes in response to President Trump's characterization of the pipeline as "inappropriate". A German government spokesman added that Germany wanted Ukraine to remain a transit route for gas imports from Russia. Trump had accused Germany of being "captive" of Russia due to its energy reliance.

Dirty tanker trade shows steady growth.

Dirty tanker trade increased almost 5% in the first six months of 2015 and grew 2.2% and 3.3% in 2016 and 2017, respectively. However, in 2018 to date, the total dirty tanker trade (measured in Metric Tons) is down 1.3% compared to the same period one year ago. The largest VLCC trade route, AG to the China Sea, which has not changed since 2014, is responsible for some 30% of the total VLCC trade. Meanwhile, the AG-USG trade, which ranked 4th in 2014 declined by 33% as import demand falls in the US. Thanks to rising exports from the US, the newly found USG - China Sea now ranks 9th. Meanwhile, Suezmaxes have seen strong growth in employment since 2014. As for the Aframax segment, the intra-Asean Far East has surpassed the Caribbean market as the largest Aframax trading area. Overall, crude oil tanker demand has been flat and rates are down due to increases in fleet size.

| COMMODITIES, (9:40 am ET ) | ||||

| CRUDE | SOURCE | UNIT | LAST PRICE | Δ PRIOR DAY CLOSE |

| Brent | ICE | $/bbl | 73.31 | -2.02 |

| WTI | NYMEX | $/bbl | 69.45 | -1.56 |

| Dubai (Spot) | Bloomberg | $/bbl | 72.64 | 1.33 |

| PRODUCTS | SOURCE | UNIT | LAST PRICE | Δ PRIOR DAY CLOSE |

| RBOB Gasoline | NYMEX | ₵/gal | 205.07 | -5.60 |

| Heating Oil | NYMEX | ₵/gal | 208.74 | -4.60 |

| NATURAL GAS | SOURCE | UNIT | LAST PRICE | Δ PRIOR DAY CLOSE |

| US Henry Hub | NYMEX | $/MMBtu | 2.76 | 0.00 |

| UK National Balancing Point | ICE | $/MMBtu | 7.69 | 0.07 |

| NATURAL GAS LIQUIDS | SOURCE | LAST PRICE (₵/gal) | LAST PRICE ($/mt) | Δ PRIOR DAY CLOSE(₵/gal) |

| US Mont Belvieu Propane (Spot) | Bloomberg | 92.75 | 483.48 | -0.50 |

| PRICE SPREADS ($/bbl) | SOURCE | LAST PRICE | Δ PRIOR DAY CLOSE | |

| Brent 3-2-1 Crack | ICE | 12.59 | -0.20 | |

MARKETS

| MARKETS, ( 9:53 am ET ) | ||||

| EQUITIES | REGION/COUNTRY | LAST VALUE | Δ PRIOR DAY CLOSE | |

| S&P 500 | United States | 2,801.31 | 3.02 | |

| FTSE 100 | United Kingdom | 7,592.16 | -69.71 | |

| DAX | Germany | 12,572.25 | 31.52 | |

| Nikkei | Japan | 22,597.35 | 409.39 | |

| SH Composite | China | 2,814.04 | -17.14 | |

| CURRENCIES | REGION/COUNTRY | LAST VALUE | Δ PRIOR DAY CLOSE | |

| £/$ | United Kingdom | 1.33 | 0.00 | |

| €/$ | European Union | 1.17 | 0.00 | |

| $/JPY ¥ | Japan | 112.40 | 0.05 | |

| $/CNY ¥ | China | 6.68 | -0.01 | |

MARKET ANALYSIS

- LNG: At least four vessels were fixed last week for single voyages loading Far East, Middle East and Atlantic City in July.

- LPG: In the next four weeks, there are 21 spot vessels open for AG loading, 17 of which are owner tonnage and 4 are relets.

- Oil prices fall as concerns about supply fade with the reopening of key Libyan ports.

- Wall Street set to open flat as weaker oil prices offset earnings.

- Dollar falls after hitting biggest weekly rise in a month.

BAKER HUGHES DRILLING RIG COUNT ($/MT)

| AREA | Week ended July 13 | Δ Prior count | Δ Prior year |

| United States | 1,054 | 2 | 102 |

| Canada | 197 | 15 | 6 |

| International | 959 | -8 | -1 |

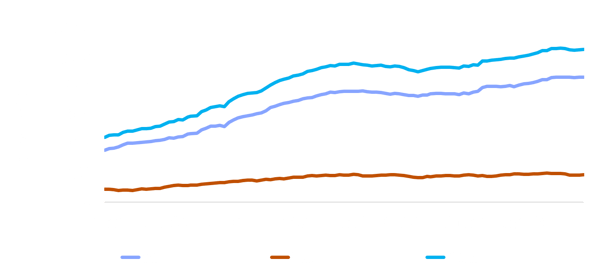

BAKER HUGHES US OIL/GAS SPLIT (July 15, 2016 - July 13, 2018)