| SHIPPING RATES & BUNKERS ( 10:10 am ET ) | |||

| DIRTY TANKER (KT - $/day) | VOYAGE | SPOT TCE EARNINGS | 2018 AVG. RATE |

| VLCC, 270 | AG-FE | 10,700 | 8,200 |

| Suezmax, 130 | WAF-UKC | 5,800 | 200 |

| Aframax, 70 | CAR-USG | 7,300 | 5,000 |

| Panamax, 50 | CAR-USG | 8,500 | 6,800 |

| CLEAN TANKER (KT - $/day) | VOYAGE | SPOT TCE EARNINGS | 2018 AVG. RATE |

| MR, 37 | UKC-USAC | 6,700 | 9,300 |

| MR, 38 | USG-UKC | (3,000) | 2,600 |

| TIME CHARTER (KDWT) | 1YR ECO RATE ($/day) | NEWBUILD PRICE ($M ) | SECONDHAND 5YR PRICE ($M) |

| VLCC , 200+ | 25,000 | 88.0 | 61.5 |

| Suezmax, 130-200 | 18,000 | 60.0 | 40.0 |

| Aframax, 80-130 | 15,000 | 48.0 | 29.5 |

| LR2, 80-130 | 15,250 | 50.0 | 30.5 |

| LR1, 60-80 | 14,000 | 42.0 | 29.0 |

| MR, 42-60 | 14,750 | 36.0 | 26.5 |

| Handymax. 30-42 | 12,750 | 33.0 | 23.0 |

| US FLAG (KT - $/day) | VOYAGE | WEEKLY SPOT RATE | 2018 AVG. RATE |

| Handy, 38 | USG-USAC | 66,948 | 63,707 |

| LNG ($/day) | WEEKLY SPOT RATE | CURRENT MONTH RATE | 2018 AVG. RATE |

| 160M3 Tri-fuel diesel electric (West) | 47,000 | 45,667 | 64,600 |

| 138-150M3 Steam turbine (West) | 33,000 | 31,667 | 42,500 |

| 160M3 Tri-fuel diesel electric (East) | 36,000 | 35,333 | 53,800 |

| 138-150M3 Steam turbine (East) | 26,000 | 25,333 | 33,950 |

| LPG (KT) | LAST POSTED SPOT RATE ($/mt) | SPOT TCE RATE ($/day) | 1yr TIME CHARTER RATE ($/day) |

| VLGC, 44 (AG-Japan) | 29.64 | 4,934 | 16,447 |

| BUNKERS ($/mt) | IFO 380 | MDO | |

| US Gulf | 445.5 | 696.5 | |

| Rotterdam | 441.0 | 664.0 | |

| Singapore | 460.5 | 698.5 | |

Kansai Electric Power to cut LNG purchases as it opts for nuclear power.

Before the Fukushima nuclear disaster in 2011, the Japanese utility was predominantly reliant on nuclear power. Of the eight reactors that have resumed generating power in Japan – a fifth of available units - four were from Kansai Electric. On the whole, the company has seven reactors. Kansai has boosted its nuclear plant utilization rate to a six-year high of 18% in 2017/18, after three-years of virtually zero usage. This has contributed to a reduction in its LNG consumption of 16.3%, down to 7.56 MT. The company will focus first on reducing its spot and short-term volumes, which now account for 20%. It will increase the ratio of nuclear, hydro and renewables in its power generation mix up from roughly 25% to more than 50% in the coming years.

Russia discusses 1 mbpd production rise with Saudi Arabia. .

In a meeting held in St Petersburg last night, energy ministers from both countries talked about loosening their commitments to the 17 month-old deal between OPEC members and others which has raised prices. With production from Venezuela falling and concerns over Iran's production rising, some producers have called for easing the deal as prices near $80 bbl. The group will meet on June 22 in Vienna and decide how to proceed.

FT May 25, 2018

National average gasoline prices rise to near $3/gal. gal ahead of Memorial Day.

Gasoline prices averaged $2.92/gal. nationally on May 21, up from last year's $2.40/gal. ahead of the holiday. This stems from a combination of rising crude oil spot prices, higher gasoline demand and falling gasoline inventories. Prices are projected to be higher this summer compared to last as the EIA expects Brent crude to be an average of $22 bbl higher.

Rosneft to supply Ghana and Mongolia with energy.

The Russian oil major announced it is signing long-term contracts worth $2.1B to supply gasoline and diesel fuel to the largest Mongolian importers of oil products. Further, it signed a package of documents to deliver LNG to the port of Tema in Ghana. Under the terms, Rosneft will supply 1.7 Mmta of LNG in a 12-year deal.

Reuters May 25, 2018

Eni looks to solar.

Italian oil major Eni is working on a joint bid for Terra Firma’s solar assets in Italy with Qatar Petroleum. Private equity investor Terra Firma is looking to sell its RTR solar portfolio in Italy in a deal that is expected to attract more than $1.2B.

Reuters May 25, 2018

| COMMODITIES, (9:40 am ET ) | ||||

| CRUDE | SOURCE | UNIT | LAST PRICE | Δ PRIOR DAY CLOSE |

| Brent | ICE | $/bbl | 77.05 | -1.74 |

| WTI | NYMEX | $/bbl | 68.87 | -1.84 |

| Dubai (Spot) | Bloomberg | $/bbl | 74.12 | -1.62 |

| PRODUCTS | SOURCE | UNIT | LAST PRICE | Δ PRIOR DAY CLOSE |

| RBOB Gasoline | NYMEX | ₵/gal | 219.28 | -4.10 |

| Heating Oil | NYMEX | ₵/gal | 222.54 | -4.13 |

| NATURAL GAS | SOURCE | UNIT | LAST PRICE | Δ PRIOR DAY CLOSE |

| US Henry Hub | NYMEX | $/MMBtu | 2.95 | 0.01 |

| UK National Balancing Point | ICE | $/MMBtu | 7.43 | -0.22 |

| NATURAL GAS LIQUIDS | SOURCE | LAST PRICE (₵/gal) | LAST PRICE ($/mt) | Δ PRIOR DAY CLOSE(₵/gal) |

| US Mont Belvieu Propane (Spot) | Bloomberg | 95.63 | 498.49 | 0.75 |

| PRICE SPREADS ($/bbl) | SOURCE | LAST PRICE | Δ PRIOR DAY CLOSE | |

| Brent 3-2-1 Crack | ICE | 15.29 | 0.02 | |

| MARKETS, ( 9:40 am ET ) | ||||

| EQUITIES | REGION/COUNTRY | LAST VALUE | Δ PRIOR DAY CLOSE | |

| S&P 500 | United States | 2,727.76 | -5.53 | |

| FTSE 100 | United Kingdom | 7,710.29 | -6.45 | |

| DAX | Germany | 12,899.84 | 44.75 | |

| Nikkei | Japan | 22,450.79 | 13.78 | |

| SH Composite | China | 3,141.30 | -13.35 | |

| CURRENCIES | REGION/COUNTRY | LAST VALUE | Δ PRIOR DAY CLOSE | |

| £/$ | United Kingdom | 1.33 | -0.01 | |

| €/$ | European Union | 1.17 | -0.01 | |

| $/JPY ¥ | Japan | 109.26 | -0.01 | |

| $/CNY ¥ | China | 6.39 | 0.01 | |

MARKET ANALYSIS

- Asphalt: Rockies retail price assessments firmed in some areas last week. May wholesale prices were steady.

- LPG: Spot propane and butane prices in the ARA region in Europe have risen $99 pmt and $80.5 pmt respectively in just a 6-week period as a combination of bullish crude runs, lower domestic supply and flat US imports have pushed up paper and physical.

- Oil prices fall behind as Russia and Saudi Arabia consider boosting output.

- European shares pulled lower by autos stocks.

MAY POSTED / SPOT PRICES ($/mt)

| MAY POSTED / SPOT PRICES ($/mt) | Propane | Butane |

| Saudi Aramco | 500.00 | 505.00 |

| Sonatrach | 470.00 | 485.00 |

| OPIS North Sea | 462.00 | 458.50 |

| Spot AG | 583.00 | 583.00 |

| CFR Japan | 596.75 | 597.50 |

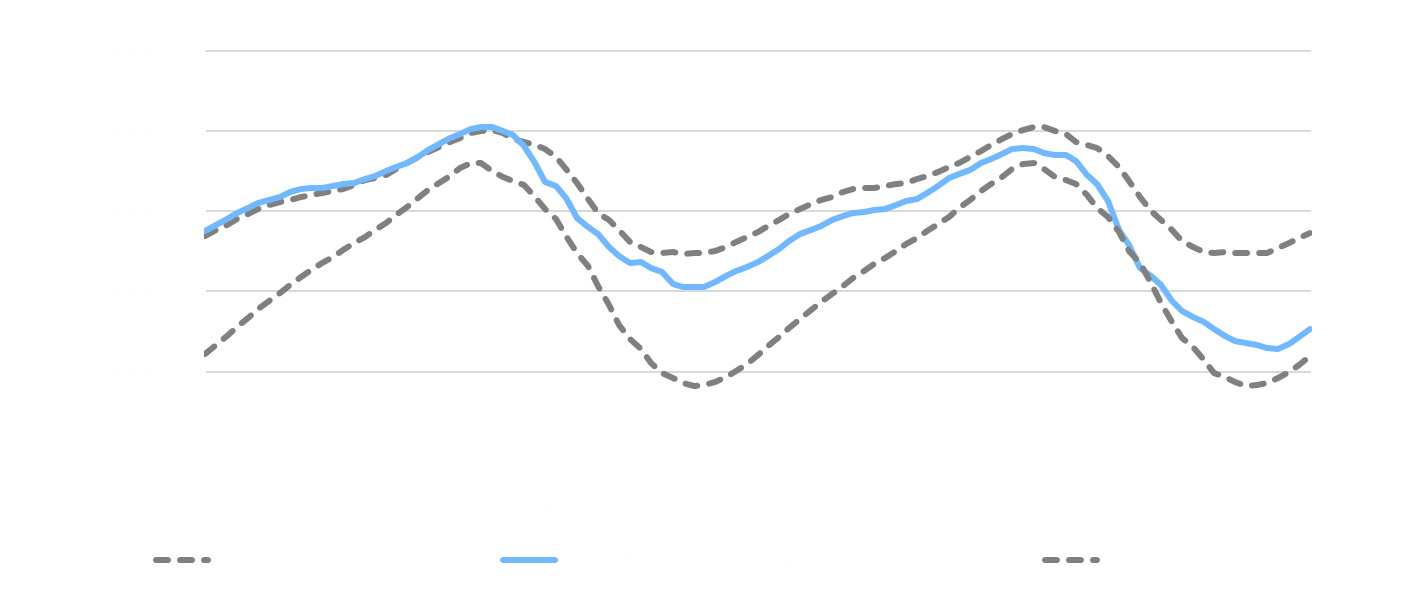

EIA US WORKING NATURAL GAS IN UNDERGROUND STORAGE

(May 2016 - May 2018)